Whether you’ve got federal loans or private loans, student loan consolidation is an option that borrowers may consider to get relief from their education loans. Student loan debt is the fastest-growing debt in the U.S. But while consolidating your loans makes sense for some, others may find they lose out on various assistance programs by making the move. Read on to learn when it makes sense to consolidate your loans, when you should avoid it, and what other options you might have.

Table of Contents

Student Loan Consolidation: What to Consider

Student loan consolidation, also called student loan refinancing, is the process of combining multiple education loans into one loan. By doing so, borrowers reduce their total monthly loans and the amount they pay per month, making payments more manageable.

There are two different types of student loans borrowers need to be aware of:

- Federal: Owned directly by the government; usually offer lower rates and access to a variety of benefits and subsidies.

- Private: Student loan servicers are private organizations like banks, credit unions, or the schools themselves; rates depend on your credit score and you have no access to government benefits.

Most borrowers prefer to take out federal student loans over private ones due to the extra privileges. It’s important to note that because of these privileges, you can’t use a federal loan to consolidate private loans. Federal student loan consolidation is a sponsored government program, not just a financial transaction. The two are entirely separate from each other in terms of payments, interest rates, and consolidation options.

The main benefit of student loan consolidation is twofold:

- Fewer monthly payments

- Reduced monthly payment amount

Other pros include:

- If you have federal student loans that are with different loan servicers, consolidation can simplify loan repayment by giving you a single loan with just one monthly bill

- A lower monthly payment gives you more time (up to 30 years) for repayment if money is tight

- If you consolidate loans other than Direct Loans, consolidation may give you access to additional income-driven repayment options and Public Service Loan Forgiveness (PSLF)

- You’ll be able to switch any variable-rate loans you have to a fixed interest rate; one that doesn’t change over the course of the loan

READ MORE: Debt consolidation

When Would You NOT Want to Consolidate Student Loans?

As mentioned above, a loan consolidation lowers your monthly payment by extending your student loan repayment term. While this might offer short-term relief, you will end up paying more over the course of the loan. This is because lower monthly payments allow interest more time to accrue over the longer repayment period, inflating the amount you owe.

Dr. Alicia Plemmons, Assistant Professor of Finance and Economics at Southern Illinois University Edwardsville, shares insights on student loan refinancing

What advice would you give to an aspiring student who is considering taking out student loans?

Spend time considering your repayment strategy. Will this degree increase your future wages by more than the loan payments? How much are the monthly loan payments? Are you willing to give up that amount of money every month for 10 to 20 years? Understanding the financial impact of loan repayment in the future will help students understand the implications of these loans, so that it is not a surprise after graduation.

Additionally, if you have a mix of federal and private loans, you’ll run into problems trying to consolidate them all into one. You cannot consolidate private loans into a federal loan, and consolidating federal loans into a private loan will cause you to lose many of your federal benefits.

However, the biggest issues with each type of loan are:

Federal student loan consolidations do nothing to lower your interest rate. You can simplify your payments, or extend the period of time you have to repay your loans, but it won’t do anything to save you money. If that was your only motive for the transaction, it’s a waste of time. Federal consolidation will end up costing you more in the end.

Private student loan consolidations can lower your interest rate, but this rate is still usually higher than federal loans. There is also typically a fee to initiate private consolidation while for federal loans this process is free.

Other downsides of consolidating your loans include:

- When you consolidate your loans, any outstanding interest on the loans that you consolidate becomes part of the original principal balance on your consolidation loan, which means that interest may accrue on a higher principal balance than might have been the case if you had not consolidated

- Consolidation may also cause you to lose certain benefits for loan borrowers —such as interest rate discounts, principal rebates, or some loan cancellation benefits— that are associated with your current loans

- If you’re paying your current loans under an income-driven repayment plan, or if you’ve made qualifying payments toward Public Service Loan Forgiveness, consolidating your current loans will cause you to lose credit for any payments made toward income-driven repayment plan forgiveness or PSLF

READ MORE: Student loan forgiveness

Federal Student Loan Debt Consolidation Options

The federal government offers five types of student loans through the U.S. Department of Education:

Direct Subsidized Federal Loan

This is a type of federal student loan where a borrower isn’t responsible for paying the loan or interest while in school, during the 6-month period after school (grace period), or during a loan deferment period where payments are postponed, such as the ones granted during the COVID-19 Pandemic.

When you receive your Direct Loan, you will be contacted by your loan servicer (you repay your loan to the loan servicer). Your loan servicer will provide regular updates on the status of your Direct Loan and any additional Direct Loans that you receive.

Direct Unsubsidized Federal Loan

A Federal Direct Unsubsidized Loan is a type of loan where the borrower is responsible for paying the principal and interest as soon as the loan is taken out. This means, unlike subsidized loans, they start accruing interest immediately instead of 6 months after graduation.

Direct Grad PLUS Loan

Direct Grad PLUS Loans are federal loans that can be used by graduate or professional students to help pay for college or career school. You don’t have to start making payments until six months after you graduate, leave school, or drop below half-time enrollment.

During any period when you’re not required to make payments, interest will accrue on your loan. You may choose to pay the accrued interest or allow the interest to be capitalized (added to your loan principal balance) when you have to start making payments. Your loan servicer will notify you when your first payment is due.

Direct Parent PLUS loan

Direct PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay for college or career school. To qualify, you must be the biological or adoptive parent (or in some cases, the stepparent) of a dependent undergraduate student enrolled at least half-time at an eligible school.

You can request deferment for this type of loan so you don’t have to make payments while your child is enrolled at least half-time and for an additional six months after your child graduates, leaves school, or drops below half-time enrollment.

Direct Consolidation Loan

The loan that’s most important for anyone considering consolidation is a Federal Direct Consolidation Loan, which allows you to consolidate multiple federal education loans into one loan. The result is a single monthly payment instead of multiple payments. Loan consolidation can also give you access to additional loan repayment plans and forgiveness programs.

Most federal loans are eligible for consolidation and you can start the process after you graduate, leave school, or drop below half-time enrollment. Other requirements include:

- The loans you consolidate must be in repayment or in the grace period

- Generally, you cannot consolidate an existing consolidation loan unless you include an additional eligible loan in the consolidation

- Under certain circumstances, you may reconsolidate an existing FFEL Consolidation Loan without including any additional loans

- If you want to consolidate a defaulted loan, you must either make satisfactory repayment arrangements (defined as three consecutive monthly payments) on the loan before you consolidate, or you must agree to repay your new Direct Consolidation Loan under the Income-Based Repayment Plan, Pay As You Earn Repayment Plan, Revised Pay As You Earn Repayment Plan or Income-Contingent Repayment Plan

- If you want to consolidate a defaulted loan that is being collected through garnishment of your wages, or that is being collected in accordance with a court order after a judgment was obtained against you, you cannot consolidate the loan unless the wage garnishment order has been lifted or the judgment has been vacated

You can start the application on the Federal Student Aid website.

READ MORE: Types of student loans

Benefits of Federal Student Aid

Federal student aid comes with multiple perks and protections that make them more flexible than private student loans, including:

- You don’t need to get a credit check to qualify for federal student loans

- No co-signer necessary

- Fixed interest rate loans

- Lower interest rates over the life of the loan than private loans offer

- If you are having trouble repaying your loan, you may be able to temporarily postpone or lower your payments

- A repayment grace period

- Income-based repayment

- Loan assistance and forgiveness programs

READ MORE: Free stuff for college students

Do You Qualify For Student Loan Forgiveness?

Many borrowers may be eligible for loan forgiveness programs that they don’t even know about. Those in certain circumstances are eligible to have some or all of their student loan debt forgiven. Before you consolidate, it’s important to be familiar with the options and to avoid scams that might try to charge you for services you can get for free.

How Does Student Loan Forgiveness Work?

While most borrowers won’t be eligible for student loan forgiveness or cancellation, it can be a boon for qualifying borrowers. If you qualify due to the type of loan you have, the career you have, or your financial situation, some or all of your loans can be discharged. Student loan forgiveness eligibility options depend on the type of student loans you have:

FFEL Loans

The Federal Family Education Loan (FFEL) Program was an older loan program that worked with private lenders to provide education loans guaranteed by the federal government. The FFEL Program ended in 2010. All loans are now made through the William D. Ford Federal Direct Loan Program.

FFEL loans are eligible for forgiveness through a variety of different initiatives, including Teacher Loan Forgiveness, Closed School Discharge, and Total and Permanent Disability Discharge. To start the process, simply contact your servicer to see if you qualify.

Perkins Loans

These types of loans were for undergraduate and graduate students with exceptional financial needs. However, as of 2017, schools can no longer make new Perkins Loans. Borrowers with these types of loans can seek forgiveness through the Perkins Loan Cancellation and Discharge program. To qualify, borrowers need to have served full time in a public or non-profit elementary or secondary school system as a:

- teacher in a school serving students from low-income families;

- special education teacher, including teachers of infants, toddlers, children, or youth with disabilities; or

- teacher in the fields of mathematics, science, foreign languages, or bilingual education, or in any other field of expertise determined by a state education agency to have a shortage of qualified teachers in that state.

Public Service Loan Forgiveness (PSLF)

If you are employed by a U.S. federal, state, local, or tribal government or not-for-profit organization, you might be eligible for the Public Service Loan Forgiveness Program. The PSLF forgives the remaining balance on your direct loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Other Types of Forgiveness

Borrowers can also receive loan forgiveness:

- If your school closes while you’re enrolled or soon after you withdraw

- If you’re totally and permanently disabled

- Due to the death of the borrower

- If you withdrew from school and the school didn’t make a required return of loan funds to the loan servicer

- If your school falsely certified your eligibility to receive a loan

- If you took out the loans to attend a school and the school failed to do something related to your loan or to the educational services that the loan was intended to pay for

If you think you qualify for one of these scenarios, contact your loan servicer to start the process.

READ MORE: Most affordable colleges and universities

Consolidating vs. Refinancing: What’s the Difference?

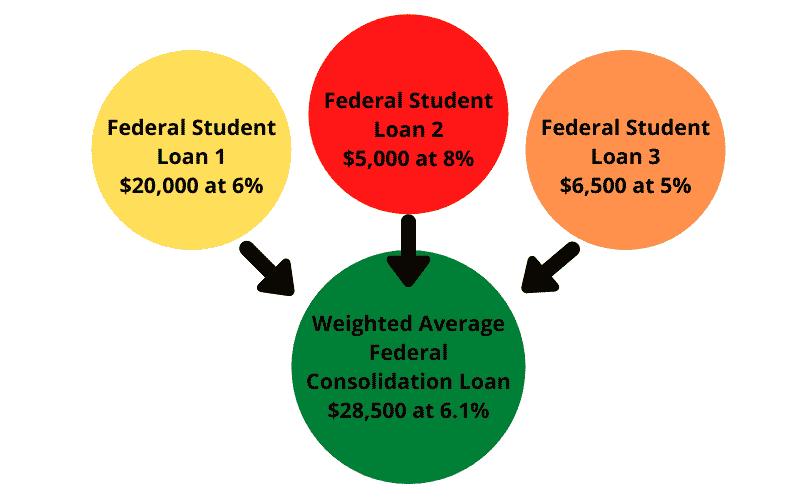

The essence of loan consolidation is the combination of multiple loans into a single loan with a higher loan amount. While the point of refinancing has nothing to do with the number of loans, only with the improvement of your loan terms (i.e. interest rate). When you begin a federal loan consolidation, your new interest rate is the weighted average of your previous loans, so there’s no change in cost, only a reduction in the number of payments.

A private loan consolidation often includes elements of a refinance, which contributes to the confusion between the two. When you consolidate your old loans with a new private loan, you can change the terms and get an improved interest rate if your credit score has increased or overall bank rates have gone down.

What Types of Student Loans Can Be Consolidated or Refinanced?

Most federal loans can be consolidated, however, none of them can be refinanced. If you want to keep the governmental privileges that come with federal student loans, you can’t consolidate your federal loans into a private loan.

For private loans, consolidation and refinancing options depend on what the financial institution you’re working with offers. If your credit score has improved or overall bank rates have gone down since you took out your loan, you can often get a reduced rate and/or combine multiple loans into one.

READ MORE: Best lenders for student loan refinancing

When You Should Choose to Refinance

Because student loan refinancing is only accessible through a private lender, its usefulness is limited. The government holds the vast majority of student loans, so most of the time a refinance of your loans would mean that you’d be giving up a lot of privileges for a slim chance at reducing your interest rate.

Dr. Daniel Howard, Professor of Marketing for SMU’s Cox School of Business, shares advice on student loan refinancing and forgiveness

WHAT ADVICE DO YOU HAVE FOR BORROWERS WHO ARE CONSIDERING REFINANCING GIVEN THE POSSIBILITY OF STUDENT LOAN FORGIVENESS?

It is not a bad strategy but understand you are playing a chess game here. I believe there is a strong possibility of some level of student loan forgiveness. However, the level of forgiveness, when it will occur, and with what contingencies is an open question.

That said, refinancing does make sense when you hold one or more expensive private loans and meet one of the following conditions:

- Your credit score has increased significantly

- Lending rates have decreased significantly

In either of these cases, you won’t have anything to lose by working with a private lender, as you’ll likely be able to qualify for a better interest rate than you held previously.

Watch Out for Scams

Just like with every other type of loan, scams have developed around student debt management. If you’re considering student loan consolidation or refinancing, make sure that you’re dealing with the proper and legitimate parties and not a scam artist.

For federal loans, you should never deal with anyone other than a representative from the Department of Education. You never have to pay for assistance from them, and they have only 9 loan servicers you work with exclusively that are government-backed.

Things become a bit less black-and-white when you’re using private loans since these are provided by a wider range of groups and individuals, but here are some good guidelines to recognize and avoid scams:

- Don’t trust a party that contacts you first by email or phone, especially if you don’t recognize them

- Be wary of any upfront fee necessary to qualify for any sort of student loan assistance

- Don’t trust anyone who promises you rapid “loan forgiveness.” Forgiveness is a rare occurrence that generally only happens after years of payments and some extenuating circumstances

When in doubt, err on the side of caution. Keep your personal information a secret whenever possible and carefully vet everyone you work with. Even if someone seems legitimate, a quick Google search and online background check can go a long way

Generally, the banking institution you worked with to get your loan in the first place will be involved in the consolidation loan application process so contact them if you have any questions on consolidation or refinancing.

READ MORE: Can you go to jail for not paying student loans?

The Bottom Line

Each borrower’s priorities and student loan situations are different, so there is no universally correct choice when it comes to consolidating student loans. That said, if you’re finding monthly payments hard to manage, consolidation could simplify your education repayments. There are other options on the table, such as loan forgiveness if you qualify based on your job or your loan type, so be sure to clarify with your loan servicer all your options before deciding to consolidate.