We’ve all been in a desperate pinch for cash at one point in our lives. Among the many options available, the fast cash, online payday installment loan should be your last resort.

But if you need to go down this road, don’t let this trail lead you deeper in debt. Research your lender options before you make a choice.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Sky Trail Cash?

Sly Trail Cash is a Native American Indian fast cash online lender that falls under the tribal laws of Lac Du Flambeau Band of the Lake Superior Chippewa American Indians in Wisconsin. These loans are not regulated by the federal government but by the tribal laws of this specific tribe.

Their website mentions shoddy credit is not a problem, instant online application, and a five-minute response time for customer service to call. They also offer a same-day funding option until 2 p.m. Central Time, or next business day funds delivery.

Is Sky Trail Cash Licensed?

These types of tribal lenders are not licensed in the states they operate in. They have their own autonomous set of laws. They are only forced to follow the rules set forth by their specific tribe, in this case, the Lac Du Flambeau Band of Lake Superior Chippewa American Indians in Wisconsin.

Both state and federal regulators regulate typical lenders we are familiar with. Tribal lenders like Sky Trail Cash have immunity and are not subject to the regular lending rules since these types of lenders are located on tribal land. It is like having diplomatic immunity.

Payday loan interest rates vary greatly but the annual percentage rate (APR) can run up to 590%. Sky Trail’s website showed two examples of loans with an interest rate of almost 780%.

Traditional payday loans are considered so predatory that they are banned in many states. Tribal loans are protected by tribal sovereignty, so state laws do not apply.

What is a Tribal Loan?

Tribal lenders are short-term, small-dollar, payday loans owned and operated by a recognized Native American tribal government. They are payday lenders based on tribal land, with loans from companies owned by Native American tribes.

The big differentiator between tribal loans and traditional payday lenders is that conventional lenders are mandated to follow the federal payday lending guidelines to ensure proper lending practices; tribal lenders are not.

READ MORE: Tribal lenders to avoid

What is Tribal Immunity?

Native American tribes have their land and laws, and they have sovereign immunity from federal and state laws and protection from outside litigation. It’s like having a separate country within a country that operates autonomously. They can do as they please. Tribal loans can charge any interest rate they wish that far exceeds state limits, provide loans with balances that are higher than state minimums, and even break the terms of their loan agreements with no federal ramifications.

While the Supreme Court and the Consumer Financial Protection Bureau (CFPB) attempt to crack down on tribal lenders, the process has been slow. Tribal lenders are holding fast to their position that they are not subject to any laws but their own.

In the meantime, lenders like Sky Trail Cash continue to offer loans that violate state laws and ruin the financial well-being of many desperate borrowers through extreme predatory lending.

Here’s What’s to Expect When Taking Out a Loan from Sky Trail Cash

- What’s the APR range? There is no interest rate cap for tribal law, so the sky’s the limit, just like the company name. They list two APR scenarios on their site that cite a 775.85% interest rate and another 779.85%.

- How much do I qualify for? The first-time borrower may qualify up to $800.

- How much can I borrow as a repeat customer? Loan amounts of $100-$1000 are available to repeat customers after successfully making enough payments.

- Payment schedule: Your first payment is due on your next payday that falls at least five days out. If it’s less than five days away, then your payment is due the following pay period. This schedule will depend on the pay frequency of your employer.

- How long is the standard repayment term? The maximum amount for biweekly payments is 14. You could be also be set up on ten biweekly payments if you are paid weekly or biweekly. If you are paid monthly, you would more than likely be set up on five monthly payments. Again, it will depend on the pay frequency at your employer and the amount of your loan.

- What if you pay the loan off early? There is no pre-payment penalty on their loan.

- What kind of late fees are assessed for missed payments? If your payment is returned because of insufficient funds, you will be assessed a $30 charge. If any payment is later by more than ten days, you will be charged an additional $20.

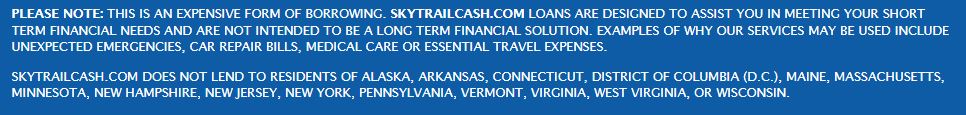

This information is noted in the fine print on Sky Trail Cash’s home page:

What’s the Difference Between a Tribal Loan and a Payday Loan?

The main difference is the federal regulatory oversight that is not allowed in tribal lands and their laws. Federal lending practices in traditional payday loans are regulated by both federal and state.

Due to the extreme predatory nature of payday loans, several states have deemed this type of lending illegal.

What are the Typical Loan Terms With Sky Trail Cash?

Your payment terms will vary. The maximum amount for biweekly payments is 14. You can also be set up on ten biweekly payments if you are paid weekly or biweekly. If you are paid monthly, you would be set up on five monthly payments. It will depend on the pay frequency at your employer and the amount of your loan.

The APR will depend on the amount you borrow. You will always have daily interest depending on the amount you borrow, including weekends. You will have three business days to pay back without any interest added, including the day you receive the funds.

There is no pre-payment penalty.

They use non-traditional credit bureaus such as Clarity and FactorTrust.

So, what is shown on their website are the “great” rates they can offer you. You will automatically be set up with a 782% interest rate if you are a new customer! These loan terms are not for an entire year; it’s broken down to a daily interest depending on the amount approved for.

You’ll see from this example from Sky Trail Cash’s site that a borrower will pay $984.01 in finance charges — a total of $1,384.01 over five months — to borrow $400.

Online Reputation

Just like anything in life, doing your due diligence and educating yourself is the front line of keeping yourself out of trouble.

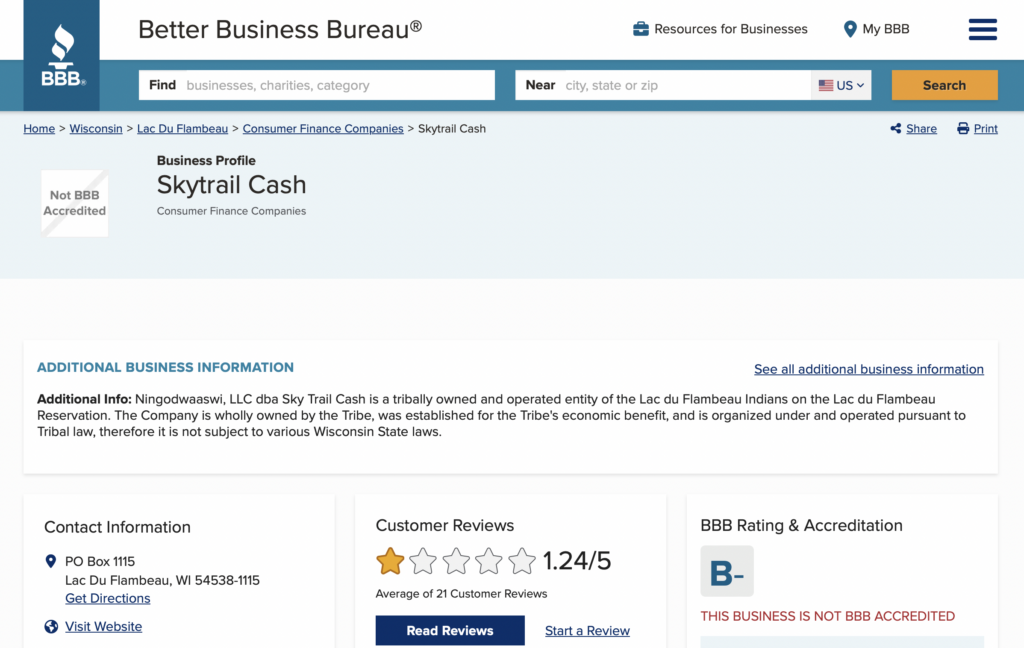

Better Business Bureau is one of the better review sites to go to since they ferret out the fake reviews better than other sites and are much more responsive to consumer complaints.

One reviewer says:

“They charge you $10 a day from the day but opens till the day you pay off and close it. They won’t work with you. Use any company but this one. Scam artists is what they are. Taking advantage of broke people and breaking them more. Read the fine print, because I read over things and still missed the fact it’s $10 a day. You’ll never pay this off.”– Cory R.

Sky Trail Cash has 72 complaints with the Better Business Bureau.

A customer complained:

“On 9 August 2021, I arranged to make an extra payment toward my loan with the company as I am hoping to pay off the loan early as the interest rates are extremely high. Also, I understand from the company that they do not charge pre-payment penalties. Well, turns out that they have another way to penalize the consumer and this is by only allowing additional payments to go to paying the interest on the loan and not the principal. This is very deceptive and I doubt that it is listed in their contract. Additionally, they will not give you a payoff quote on their website and do not give you option to payoff the loan.”

It’s worth noting that Sky Trail Cash does often respond to complaints and takes action, which is not always the case with other lenders.

What Are the Pros and Cons of Tribal Loans?

Pros

- An alternative to payday loans is if your state has banned traditional payday loans.

- Fast cash, convenient

- A resource is you have bad credit and can’t secure a loan through a conventional lender.

Cons

- Astronomical APRs

- Unregulated

- Short-term loan

How to Apply for a Loan from Sky Trail Cash?

The loan application was quick and easy. All you need for loan approval are:

- Be 18 years of age or older, and be a citizen or permanent resident of the United States

- A consistent source of income for at least the past 90 days

- A valid checking account in your name

- To have a valid email address, a current home phone number (as well as a work phone number, if applicable).

Better Alternatives to Tribal Loans

Here is a list of lending options you should exhaust before considering a tribal loan.

- Borrowing from friends and family is a no-brainer and the best place to start on the list.

- Use a credit card advance or low-interest balance transfer offer.

- Home Equity Line of Credit (HELOC): This loan uses a percentage of equity in your home to get cash.

- 401(k) loan: Borrow funds against your retirement plan.

- PenFed credit union or your credit union: PenFed has low 5.99% APR’s for a personal loan, no origination fees, no pre-payment penalty, terms up to 60 months, loans up to $50,000, and no hidden fees.

- Peer-to-peer lending: These are personal loans funded by individuals or businesses. Upstart would be an excellent place to start. If you have a certain amount of user history with Reddit, you can borrow money from other Reddit users at r/borrow.

- Reputable Online Lenders: SoFi is a great place to look with no origination fees, low APRs starting at 4.99%, flexible terms, no fee personal loans, and a limited time $500 welcome bonus.

- Paycheck Advance App: Earnin allows you to borrow against your paycheck if you have direct deposit without any fees or interest payments. You can withdraw some of the wages you have already clocked but haven’t gotten paid for.

The Bottom Line

Tribal loans are generally considered to be an alternative to payday loans. Payday loans in themselves are already considered predatory and outlawed in many states. This being said, exhaust all avenues before turning to a short-term loan, and if this is your only option, please make sure you know the terms and interest rates, and will be able to make the payments.

Otherwise, the trail you’ll be following will almost certainly turn out to be a dead end.

FAQs

You can reach Sky Trail Cash by phone at 844-650-5931 or by email at customerservice@skytrailcash.com.

Sky Trail Cash is based in Lac du Flambeau, Wisconsin.

Sky Trail Cash does not lend to residents of Alaska, Arkansas, Connecticut, Illinois, Maine, Massachusetts, Minnesota, New Hampshire, New Jersey, New Mexico, New York, Pennsylvania, Vermont, Virginia, West Virginia or Wisconsin. Residents of Washington D.C. also are not eligible.