Minto Money promises simple online installment loans up to $3,000 without a minimum credit score requirement, and you can have your money as soon as the next business day.

But is Minto a lender you can trust? Read on to learn what customers think.

Hot take: Minto Money’s website makes it look like a traditional lender, but it is a tribal lender. It is a wholly owned subsidiary of Benhty Economic Development Corporation, which operates under the laws of the Native Village of Minto, a Native American Indian tribe in Alaska. This means the lenders can follow the tribe’s rules rather than state laws. If you borrow from Minto Money, expect to pay interest rates of 500% APR — or even higher. Many customers report that they repaid more than twice the total amount they borrowed.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

Minto Money is a Tribal Lender

Minto Money is an online tribal lender that offers small installment loans to people who need cash fast to cover an unexpected financial emergency. The lender is owned by a federally recognized sovereign American Indian tribe. Unlike some other tribal lenders, Minto Money adheres to federal laws and regulations regarding their short-term loan products.

However, if you live in a state where payday loan interest rates are capped, do not expect Minto Money to recognize those state laws.

Pro tip: Although Minto Money claims they do not offer payday loans, their installment loans come with a high annual percentage rate (APR). usually in the triple digits. For context, most personal loans have an APR between 6% and 36%, while even high-interest credit cards cap out at 36%.

The only advantage of Minto Money’s installment loans over traditional payday loans is that these loans come with longer repayment periods. This makes it easier for most borrowers to make on-time monthly payments until the loan is paid in full. The downside is that many borrowers will repay more than double the amount they borrow.

Like many other short-term, online lenders, Minto Money has a disclaimer on their website that installment loans are meant as a short-term solution rather than a long-term one.

It states:

This is an expensive form of borrowing and it is not intended to be a long term financial solution. Please note: Minto Money loans are designed to assist you in meeting your short-term borrowing needs and are not intended to be a long term financial solution.

READ MORE: What is a tribal loan — and tribal lenders to avoid

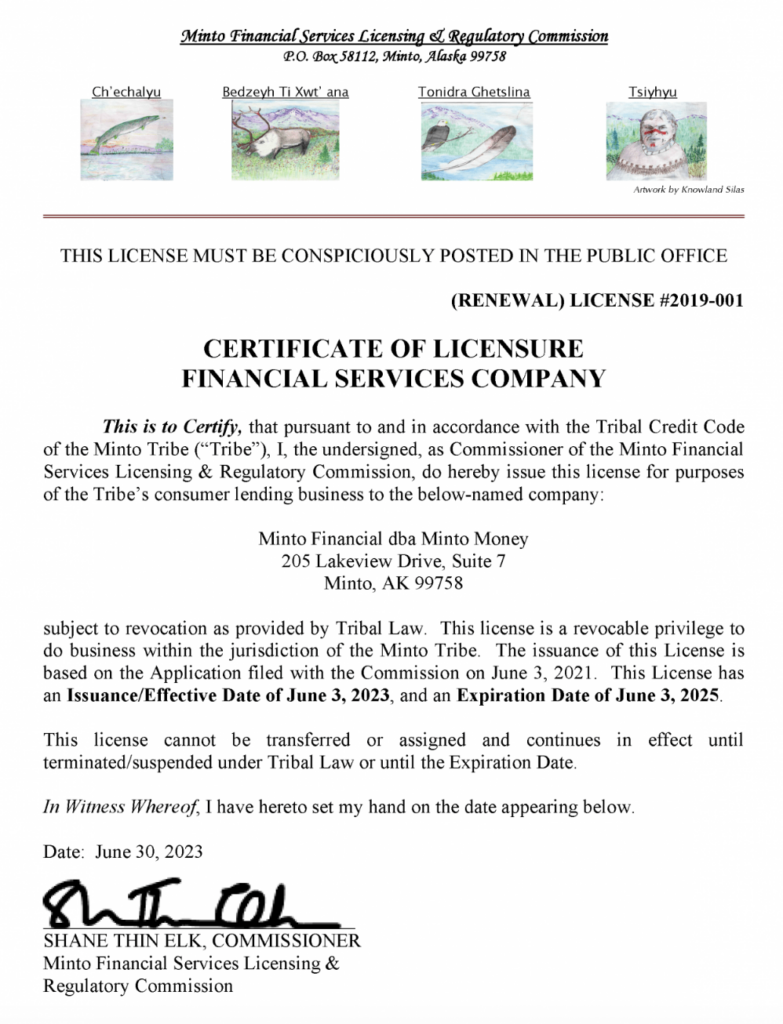

Is Minto Money Licensed?

In short, no.

Minto Money is part of the Minto Tribe, or Native Village of Minto, in Alaska. Although Minto Money is in Alaska, the lender is not licensed by Alaska banking regulators. This means they do not have to abide by state regulations or laws. For many tribal lenders, this is common since they are usually owned and operated by the tribe and thus adhere to tribal law.

Instead, Minto Money is licensed by the tribe that owns the lender.

Many unlicensed tribal lenders hold themselves above the law and provide loan products that are highly profitable to them but that end up being hugely problematic to borrowers.

Minto Money is an Online Lenders Alliance (OLA) member. The OLA is an association that says it’s committed to advocating on behalf of its members and the industry against unfair and unwarranted legislation and regulation (This means it advocates against legislation that protects borrowers). However, the OLA is mostly known for making large campaign contributions to lawmakers who protect the payday lending industry through the OLA Political Action Committee (OLA PAC)

Minto Money also does not issue loans to residents of Alaska, Arkansas, Connecticut, the District of Columbia, Illinois, Minnesota, New York, Pennsylvania, Vermont, Virginia, or West Virginia.

Minto Money Has Tribal Immunity

The U.S. Constitution grants sovereign immunity to Native American tribes, meaning the tribes can govern themselves and set their laws.

As a tribal lender, Minto Money may claim tribal immunity. This means the lender is immune to criminal or civil prosecution. It also means they can do things like:

- break the terms of their loan agreements as they see fit

- offer higher loan balances than other lenders

- charge interest rates beyond state limits

- ignore state laws means to protect the consumer’s best interests

The Supreme Court and the Consumer Financial Protection Bureau (CFPB) have been trying to crack down on tribal lenders to protect consumers from unfair or predatory lending practices. However, this slow process has been mired in partisan politics. Meanwhile, tribal lenders continue to offer loan products that financially devastate their customers.

Considering a Loan from Minto Money? Here’s What to Expect

Although Minto Money promises transparency from beginning to end, the lender keeps certain things like the exact APR and the loan duration vague until the loan application is approved. While the consumer can decline the loan offer once they review the terms, this lending practice has a few significant issues.

For one thing, some consumers may feel pressured to continue the process and sign the loan agreement even if the terms are not as expected. For another, the terms may be misleading, or the contract’s wording may be tricky.

Take, for example, the experience of Heidi S. She began the application process with Minto Money, and the lender was demanding her bank account information before she knew whether she had been approved. When she felt uncomfortable about providing confidential information, she ended the application process and started investigating. Never provide information over the phone if you aren’t comfortable with strangers having it.

Online Reputation

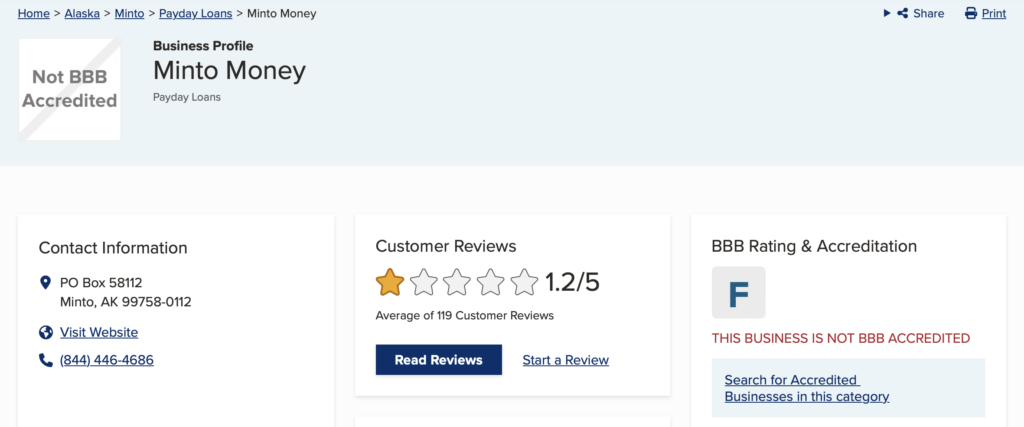

On Trustpilot, Minto Money has 4.7 out of 5 stars with around 3,800 customer reviews. Most complaints are related to vague loan terms and high APRs. Some consumers say the lender feels like a scam because it doesn’t disclose the full terms and rates of the loan until it’s too late to back out.

Minto Money has an F grade on the Better Business Bureau page and an average rating of 1.2 out of 5 stars with 119 reviews. The lender is also not BBB-accredited. Overall, many reviewers on the site felt Minto Money’s loan terms were misleading and unreasonable.

Here are a couple of standout reviews:

- Lisa S. wrote: My payments for $3,000 started in May of 2023 for $567 every 2 weeks, and today is November 13th, 2023 and I still owe $3,200. That is the payoff quote. They have hurt me, and I’ve lost my home.

- Danielle G. wrote: “I am writing a review to warn or encourage others to NOT use this company for a payday loan or any other type of loan due to the un godly Interest rate they will charge you for a loan. The interest rates they charge you are from 500+% to 799%.”

The high cost of borrowing is a common theme: Valory H. explained that she borrowed $1,000, which would have ordinarily been repaid within two months. But in the end, because of interest rates she didn’t understand, she repaid more than $5,000.

The tribal lender has responded to several negative reviews online, but the responses all seem to follow a template. Minto Money further indicates they provide full disclosure on all loan fees and rates, but they don’t indicate when.

When considering an online lender, research to ensure you know what you’re getting into before committing to a loan.

Class Action Lawsuit

Minto Money was recently named in a class action lawsuit, Hall vs. Minto Development Corp., alleging that Minto has engaged in a “rent-a-tribe” scheme to avoid prosecution under state laws. The filing claims they’ve used the scheme to issue illegal loans with APRs over 700%.

The suit says that a non-tribal member, defendant Douglas William Isaacson, controls BEDCO.

Typical Loan Terms with Minto Money

In general, these are Minto Money’s typical loan terms:

- An average of 530% APR (though this varies based on factors like the loan amount and term)

- Principal balances between $100 and $2,500 for first-time borrowers

- Loans up to $3,000 are available for repeat customers who’ve successfully repaid their previous loan

- Terms vary but may average out at around 10 months with monthly payments

- No prepayment fees

- Payments that are more than 5 days late will incur a $20 late fee plus additional interest

- $30 fee for returned payments

- Option to cancel the loan by 4 PM Central time the next business day

For the most part, these are relatively standard terms for most tribal lenders.

What are the Pros and Cons of a Loan from Minto Money?

Pros

- Fast, secure, and easy online application process

- Borrowers with bad or no credit can qualify

- High income isn’t needed to qualify

- Funds are usually available within one business day

- Minto Money allows early payment without penalty

Cons

- The loans may have long terms, which means higher interest

- The loans have an extremely high APR

- Loan terms are often misleading and kept vague until the contract is signed

- Not state-licensed

- Other fees exist, including $20 late fees and $30 nonsufficient funds fees for returned payments.

- Not available in all states

- Not available to active duty military members

- These loans can hurt your credit score due to a hard inquiry on your credit report

How to Apply for a Loan from Minto Money?

Like most tribal lenders, Minto Money has minimal eligibility requirements.

To qualify for a loan through Minto Money, you’ll need to be 18+ years old, have an active checking account and a source of income, and provide basic contact information.

The lender does not lend to borrowers with an active bankruptcy case. It also does not accept savings or prepaid accounts. All payments must be made via money order, cashier’s check or direct transfer.

If you want to apply for an installment loan with this lender, here’s how to do it.

- Use the slider to indicate how much you want to borrow. Then, fill in details like your full name, email, and state.

- Follow the prompts and provide details about your contact information, military status, and income. For the income section, be prepared to give information on your income type (employed, no regular income, etc.), length of employment, job title, payment frequency, and previous and upcoming payment dates. Alternative incomes like alimony or child support are accepted.

- Then, verify your identity with the following information: driver’s license or state ID number, date of birth, and social security number.

- Fill in details about your bank account.

- Finally, check the boxes to agree to Minto Money’s Terms and Conditions and allow them to contact you.

- Click “Submit Application” and wait for approval.

Pro tip: Only start an application with Minto Money if you intend to complete it. Otherwise, the lender may be able to save your data and contact you later about completing your loan request.

Better Alternatives to Tribal Loans

Even the best tribal loans are an expensive form of debt that should be avoided. The good news is that there are plenty of alternatives. Here are just a few:

READ MORE: Best small loans — even if you have bad credit

More Borrowing Options

- Peer-to-peer lending

- Credit card advance

- Home equity loan or home equity line of credit (HELOC)

- 401(k) loan

- Paycheck advance apps

The Bottom Line

If you need cash fast and have nowhere else to turn, Minto Money may be able to work as a short-term, one-time solution. But it should only be considered as a last resort. Minto will likely leave you repaying more than double what you borrow.

FAQs

Minto Money says it is operated by the Benhti Economic Development Corporation, an economic arm of Minto, a federally recognized Native American tribe located in Alaska

You can learn more about Minto Money by calling (844) 446-4686, visiting mintomoney.com or going to your Minto Money login page.

You may be eligible for a Minto loan even if you’ve got a bad credit score. Eligibility criteria are less stringent than with traditional lenders. You must:

–be 18 or older

–not be in the midst of a bankruptcy case

–be willing to share personal data, like bank account information and income.