Taking on debt is a risky proposition. If you choose the wrong lender, you could wind up in more financial trouble than you were in before. That’s why it’s always best to thoroughly research a provider before doing business with them. It can tell you what you can expect to pay, how prior customers’ experiences have been, and whether or not the company seems like a good fit. If you’re looking for information about MaxLend, you’ve come to the right place. Let’s take a look at what they have to offer.

Unfortunately, they don’t do much to differentiate themselves from the lenders that they so readily condemn. Their only argument is the following: “Because installment loans have a predictable repayment schedule, the borrower won’t be trapped in a never-ending debt cycle like what often is the case with payday loans.”

That argument doesn’t hold up under any sort of scrutiny. Payday loans also follow a predictable repayment schedule, albeit a much shorter one. In any case, predictability doesn’t make a loan any easier to repay when it’s as expensive as payday (or MaxLend’s) loans.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What You Need to Know About MaxLend

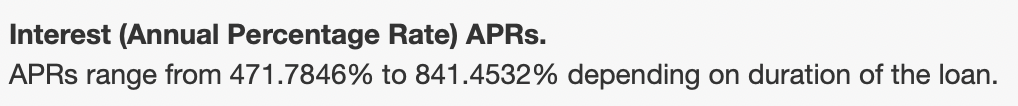

The most important thing you need to know about MaxLend is buried in the fine print on the home page. It says:

That’s a very expensive loan, even if you qualify for a loan on the lower end of the range.

Additionally, MaxLend does not loan to active-duty military service members, or residents of: Arkansas, Connecticut, Georgia, Hawaii, Illinois, Massachusetts, Minnesota, New York, North Dakota, Pennsylvania, Vermont, Virginia, Washington, or West Virginia.

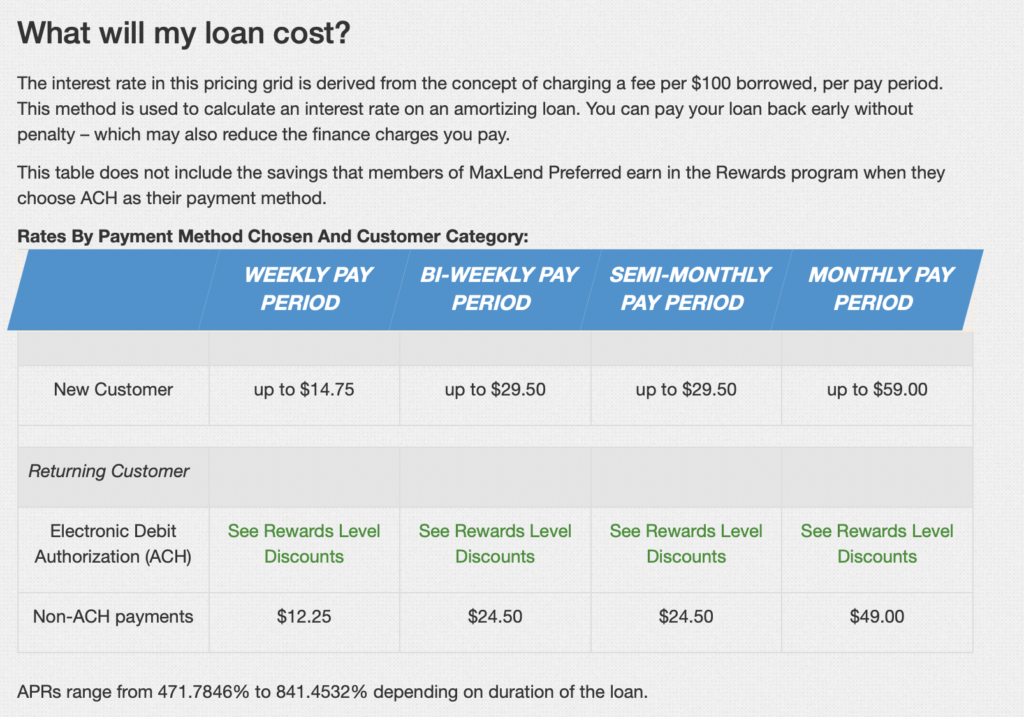

MaxLoan provides the following chart to show the cost of its loans:

At first glance, this might seem like a reasonable payment, but this shows the INTEREST ONLY that you’ll pay FOR EACH $100 borrowed. That means that if you borrow $500 and you’re paid bi-weekly, you’ll pay $29.50 x 5, or $157 per pay period in interest, not counting the loan principal. If you pay over the average nine-month repayment period, you’ll pay $2,655 in interest only, not counting the $500 you borrowed.

Is MaxLend Licensed?

MaxLend’s mailing address is in North Dakota, but they don’t have a license to practice from the state. They’re a tribal lender, which means that they operate under the laws set forth by their Native American tribe (not the federal or state governments). In this case, that’s the Mandan, Hidatsa, and Arikara Nation.

In theory, there’s nothing wrong with borrowing from a tribal lender. In practice, it doesn’t work out so well. They have a habit of using their status as a sovereign nation to avoid playing by the rules meant to protect consumers. It’s debatable whether they have to respect American courts at all, which makes it difficult to sue them.

Like most tribal lenders, MaxLend has a disclosure at the bottom of their home page that warns people about this. It says:

“MaxLend is regulated by the Tribe. If you do business with MaxLend, your potential forums for dispute resolution will be limited to those available under Tribal law and your loan agreement. As more specifically set forth in MaxLend’s contracts, these forums include an informal but affordable and efficient Tribal dispute resolution, or individual arbitration before a neutral arbitrator. Otherwise, MaxLend is not subject to suit or service of process.”

That means that there’s not much a borrower can do to fight back if MaxLend violates their rights as a consumer or if they break the terms of their contract.

Typical Loan Terms

MaxLend markets itself as a better alternative to payday loans, but their products aren’t any more affordable. They have APRs that are just as high as anything you’d get from a payday lender. Here’s what to expect their loan terms to look like:

- Principal balances between $100 and $3,000

- An APR between 472% to 841%

- Weekly, biweekly, semi-monthly, or monthly payment schedules available

- Nine-month repayment terms, on average

- Discounts available for return customers and ACH payments

- No fees for paying loan balances off early

- Fees for non-payment, late payment, and partial payment

These terms are comparable to other tribal lenders, although their upper limits on their principal balances are higher than most. That doesn’t mean that they’re a good deal, though. If anything, a higher loan balance means even more trouble for most people.

Online Reputation

MaxLend has been around since 2012, so there’s a pretty substantial amount of information on them floating around the internet. It’s always a good idea to check out what previous customers have to say when analyzing a lender, so we took a look at a few other Maxlend review sources.

Better Business Bureau

The Better Business Bureau (BBB) offers a unique perspective on businesses. Unlike direct crowdsourced review sites, their rating system is exclusively about customer service. They receive complaints from customers about the businesses on their site, then share them with the business in question. Their rating is a representation of how well the company handles those interactions.

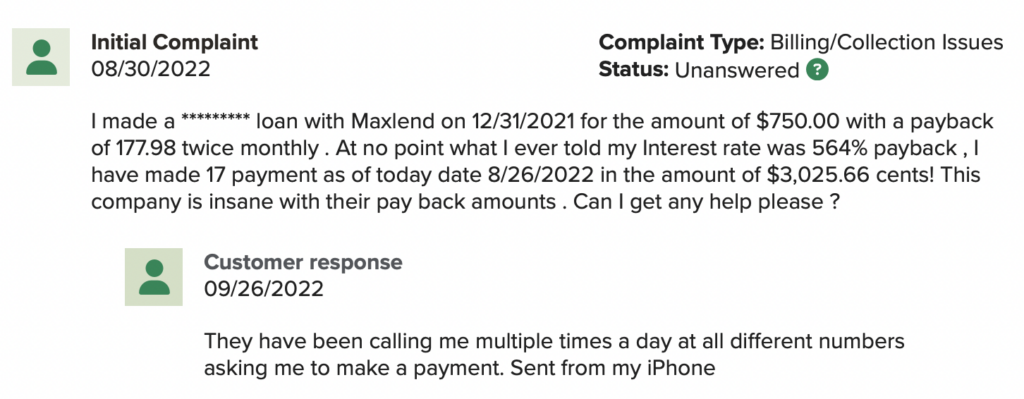

MaxLend’s BBB rating is an F, which is the lowest rating possible. The BBB’s explanation is that they received more than 55 complaints over the past three years and MaxLend failed to respond to all but two. Most are typical complaints that almost all tribal lenders receive (about how expensive their loans are).

There are also several about MaxLend failing to follow through on their promises.

For example, they say that MaxLend:

- Changed the details of already finalized contracts

- Continued to harass customers after promising to halt collection attempts

- Refused to cancel loans at the onset of the process even though the option is in the contract

These are serious accusations. Borrowing money from a lender means placing a lot of faith in them. They’ll be able to share your data and charge your bank accounts at will. It’s extremely risky to work with one that might not be entirely trustworthy.

Crowdsourced Review Sites

Crowdsourced review sites paint a similar picture. Best Company’s user reviews average 1.2 out of 5 stars. Many of the reviews state that they’d give 0 stars if they could. Almost all of the reviews give the lowest rating possible

There are some 5-star reviews, but they seems suspect. In one, the user claims that, while their loan was expensive, they knew that going into the process. That’s eerily similar to the standard response that MaxLend uses when people complain about their prices.

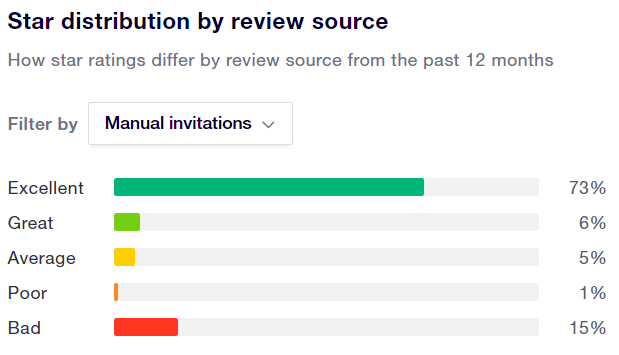

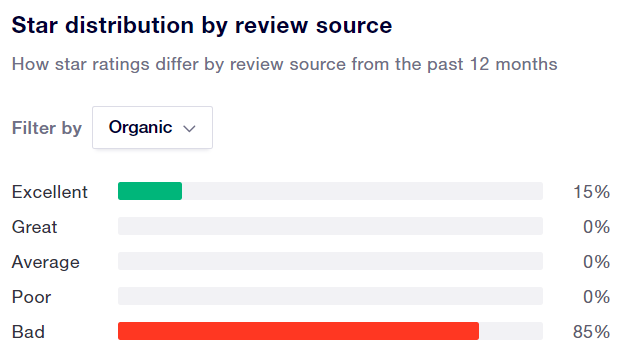

Trustpilot is a similar review site. Tribal lenders seem to favor it, perhaps because the numbers are easier to manipulate. Many online review sites are vulnerable to fake reviews and gatekeeping (only allowing reviews from people who will likely say good things). Trustpilot ha been susceptible to this, but the company said it has been taking steps to weed out reviews that might not be legitimate. One way to get an idea of the legitimacy of a company’s reviews on Trustpilot is to filter them by source.

Here’s the difference between the MaxLend review scores at Trustpilot when you filter by those directly invited and the ones that occurred organically:

The significant discrepancy between the two seems to indicate that MaxLend is paying for fake reviews or otherwise manipulating the results.

Taking out a loan from a tribal lender is almost always a mistake, but it’s an understandable one. There are reasons why they continue to do business despite their astronomical costs, and MaxLend has many of the same draws as the others in the industry.

MaxLend is an online lender that provides short-term installment loans, in theory to help people with their financial emergencies. They position themselves as a superior alternative to payday loans, which they’re refreshingly quick to admit are dangerous to borrowers.

Here’s what they have going for them:

Pros

- A quick and easy application process

- The willingness to lend to people with bad credit and a low income

- Funding of loans as quickly as a single business day

- Low principal balances that are convenient for covering small emergencies

Without context, these loans sound like the perfect way to get a little bit of cash for those who need it. Unfortunately, when it sounds too good to be true, it usually is. Somehow, it seems that many borrowers don’t take the time to read the fine print before signing up for one of these loans. If they paid more attention, they’d see the danger that they present.

Cons

We’ve mentioned it before, but it bears repeating: These types of loans are very rarely a good idea. It would take a very specific series of events (a necessary expense coming due during a brief period of no resources, immediately followed by an influx of cash to pay off the debt before interest accrues) to make an argument for these loans that would hold water.

Here’s why they’re so dangerous:

- The price is exceptionally more expensive than other options (even with bad credit).

- Taking a loan you can’t afford to repay will usually only delay the problem and make it worse.

- Tribal lenders like MaxLend don’t have to play by the rules, and there’s not much that consumers can do to make them.

The first two issues are fairly straightforward, and borrowers who know and accept the costs can only be so upset by them. The third issue is more subtle and can prove to be potentially even more devastating. Tribal lenders can get away with bending the rules in a way that costs a borrower thousands. They’re also much more likely to, if for no other reason than that they don’t have nearly as much incentive not to as other lenders.

How to Apply for a MaxLend Loan

While MaxLend’s requirements are much less strict than those of traditional lenders, they still want some assurance that they’ll get their money back. To qualify for one of their installment loans, borrowers must:

- Demonstrate a reliable source of income above their minimum threshold

- Have a checking account open long enough to meet their minimum duration

- Be at least 18 years old and a United States resident

- Live in one of the states where they operate

- Not be in the midst of (or planning) bankruptcy

- Not be an active military member, their spouse, or their dependent

Note again that none of these have anything to do with a credit score. People with bad or no credit will be able to qualify for a loan. After meeting these qualifications, all that’s left to do is apply.

As we’ve said, one of MaxLend’s few redeeming qualities is their application process. It’s easy, all online, and shouldn’t take more than a few minutes. There are only three sections:

- About You: identifying information, address, and contact details

- Income: information on employment and any other sources of income

- Banking: checking account details for providing loan funds and collecting payment

None of these questions should be particularly difficult to answer. Just make sure not to share your data too frivolously. Providing sensitive personal information to a third party is always risky, so don’t give it up without good cause.

Better Alternatives to MaxLend

Many people turn to lenders like MaxLend because they think they don’t have the credit scores to qualify for anything better. While having bad credit definitely disqualifies some options, there are always plenty out there for people who have made mistakes with their credit before.

Here are a couple of our favorite alternatives to MaxLend:

- Personal Loans for Bad Credit: There are many lenders out there that are willing to lend to people with bad credit without charging an arm and a leg. For example, LendingPoint offers loans to people with credit scores as low as 585, and their maximum APR is only 36%. That’s still expensive, but it’s a far cry from even the best one can hope for from MaxLend.

- Secured Credit Cards: People with bad credit don’t have to take out a loan to get financial support. Those who can afford to put down a deposit on a secured credit card may qualify even with low scores. It might not be the best option for people already in crisis mode, but it’s a good way to prepare for problems in advance. Borrowers can then use the same account repeatedly instead of having to take out successive loans.

- Cash advance apps: Try downloading a cash advance app (Earnin is a good one) right to your smartphone. It’s free. These apps allow customers to get an advance on their next paycheck. Users usually aren’t charged any interest or fees, instead they ask customers to leave a “tip” for the service.

Each of these options will be a much better choice than MaxLend for someone who needs financial support and doesn’t have access to traditional lending options. Of course, those with good credit who are only considering MaxLend because they didn’t know the cost should stick to banks with better terms, if possible.

The Bottom Line

If you’re looking for a simple recommendation on whether or not to use the company, we’re happy to oblige: Don’t bother. They’re far too expensive. It’s tempting to take advantage of what can seem like free money, but these loans are the opposite of free. Take your business somewhere else, whenever possible.

If your financial situation is desperate enough to warrant considering an emergency loan, it might be worth working with a credit counselor. They’re experts in getting out of debt, budgeting, and managing credit. Best of all, their advice is free. Find a local credit counselor today!

FAQS

You can reach MaxLend by phone at 877-936-4336.

MaxLend lists its business address as P.O. Box 760, Parshall, ND 58770. However, the company’s Better Business Bureau page says the company is based in Los Angeles.

MaxLend offers a loyalty program that offers lower interest rates to borrowers who’ve already repaid one loan with the company. The more loans you repay, the more your interest rate improves. However, borrowing from MaxLend is still far more expensive than a loan from a traditional lender.