Editor’s note: Majestic Lake Financial is no longer funding new loans, but the lender is still offering loans to previous customers. Anyone seeking new loans will be referred to partners Uprova and Mountain Summit Financial.

According to Finder.com, 131 million Americans took out a personal loan within their lifetime. Since the United States Census Bureau puts the U.S. population at about 333 million Americans, that means more than a third of the country’s residents have needed to take out a loan for one reason or another. If you find yourself in this statistic, it’s important that you do your homework when choosing a lender for your personal loan.

Is Majestic Lake Financial a good place to choose? Let’s take a look.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Majestic Lake Financial?

Majestic Lake Financial is a tribal lending entity that offers small personal loans via its online platform. The company’s “Who We Are” page reveals that their target consumer is one with low credit that needs a flexible repayment plan. The company does not list the date that they first went into business; however, the Better Business Bureau (BBB) reports that they were incorporated in 2013.

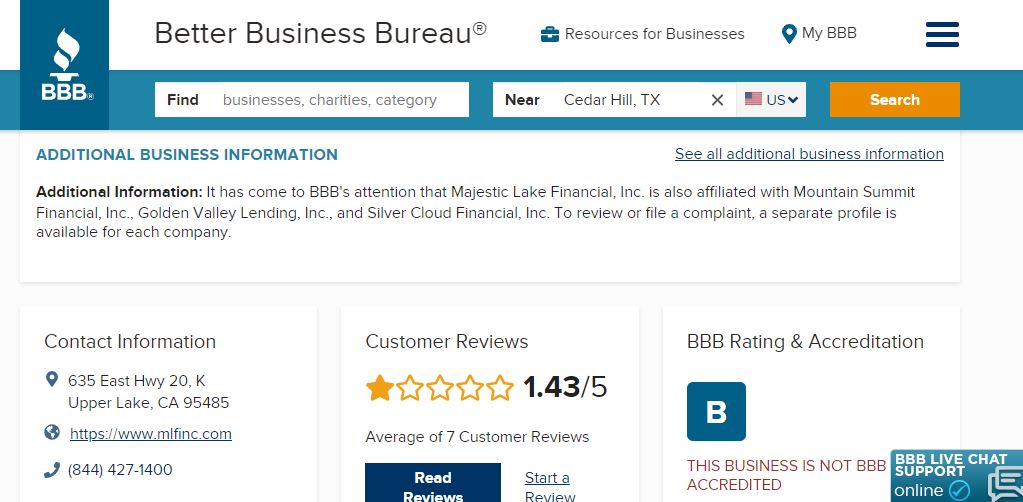

The BBB goes a step further by placing an “Additional Information” alert at the top of their review page. It states that Majestic Lake Financial has been found to be affiliated with Mountain Summit Financial, Inc., Golden Valley Lending, Inc., and Silver Cloud Financial, Inc. Potential borrowers may wish to take some extra time to check up on these companies as well.

Is Majestic Lake Financial Licensed?

Since Majestic Lake Financial is wholly owned and operated by the Habematolel Pomo of Upper Lake, Calif., which is a federally-recognized sovereign American Indian tribe, they are not required to follow any state rules and regulations when it comes to licensing and loan terms. The lender is not licensed in the state of California and it charges more than the state’s maximum interest rate of 459%.

Many tribal lenders will issue their own financial licenses and then display them on the company website. Majestic Lake Financial doesn’t even do that. They do, however, state that they are a member of the Online Lenders Alliance (OLA). Customers who believe that Majestic Lake Financial is participating in fraud or practices that go against OLA’s Code of Conduct can file a complaint with the organization by calling the OLA Consumer Hotline at 1-866-299-7585 or sending an email to complaints@oladc.org.

Typical Loan Terms of Majestic Lake Financial

It is difficult to state exactly how the loan terms of Majestic Lake Financial stack up against other loans, as the company is not forthcoming in disclosing its rates and terms. You won’t find either of these figures on the company’s website or in their “Terms of Use.” In fact, the “Terms of Use” published on the website haven’t even been updated in the last seven years.

CBS News reported on a lawsuit filed against the company by federal regulators. In that story, it is revealed that Majestic Lake Financial was charging customers between 440% and 950% in interest. The story also alleges that the company did not follow the Truth in Lending Laws and properly disclose all of the loan’s terms to the customers before they agreed to borrow money.

- Ability to borrow between $300 and $1,000 if a first-time customer.

- Repeat customers can borrow up to $1,500.

- Loan terms are only disclosed after you apply.

- Loan interest rates are only disclosed after you apply.

- Approved funds available as soon as the next business day.

Online Reputation

When choosing a local hair salon, you’re likely to call a few friends first to get recommendations. Since Majestic Lake Financial operates solely online, you’ll need to search the web for customer reviews to determine whether the company delivers on its promises.

The BBB is a good place to start. Majestic Lake Financial is not BBB accredited and currently has a grade of “B.” Reviewers, however, rate the company 1.4 stars out of 5 stars.

There have been more than 30 complaints made to the BBB. One reviewer, Robert F., stated that he took out a $1,000. He believed that he would have to make four bi-weekly payments to pay it off and that the total interest would come to $400. Instead, he was given a 10-month repayment schedule that resulted in him paying $4,000 for a $1,000 loan.

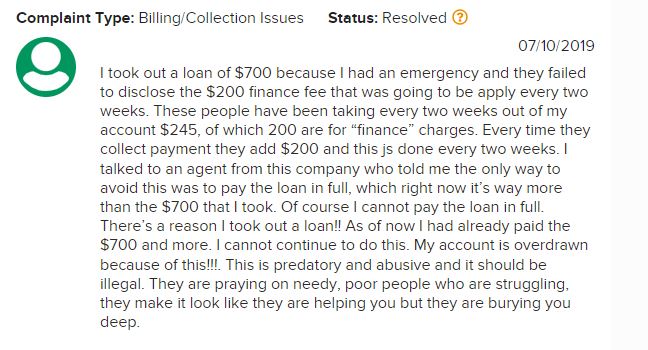

One complaint describes confusion over fees, billing and collection issues.

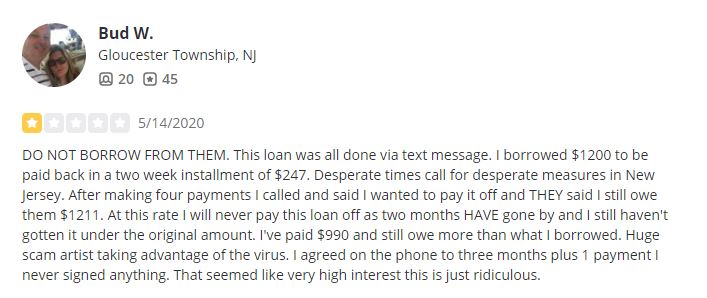

On the popular review site Yelp, there are currently two reviews warning potential borrowers about Majestic, including this one from Bud W. describing his experience:

Pros of a Majestic Lake Financial Loan

- No application fees.

- No prepayment penalty.

- Quick access to funds.

- Individuals with poor credit and no credit may still qualify for a loan.

Cons of a Majestic Lake Financial Loan

- $20 insufficient funds fee.

- Extremely high interest rates.

- Not available in all states.

- Loan terms are not clearly defined on the website.

How to Apply for a Majestic Lake Financial Loan

Should you wish to proceed and apply for a loan with Majestic Lake Financial, you’ll need to follow the steps below.

- Make sure you meet the company’s minimum requirements to apply. For example, you must be at least 18 years of age and a legal resident of the United States.

- Head to the company’s homepage, choose how much money you’d like to borrow from the drop-down menu, and click the blue “Apply Now” button.

- Choose “Yes” if you’ve previously received a loan from Majestic and “No” if this is your first time requesting a loan with the company.

- Enter your name and email address in the provided boxes.

- Create a password that’s a minimum of six characters with at least one letter and one number.

- Check the reason you need to borrow the money from the provided list.

- Check the box that matches your credit score and then answer whether you are in the military or not.

- Add your phone number and date of birth.

- Type your home address into the provided boxes.

- Answer whether you rent or own your home and how long you’ve been at your current residence.

- Provide your social security number.

- List your driver’s license number and that state in which the license was issued.

- Choose your highest level of education.

- Select your industry and occupation from the drop-down menus.

- Check your employment status and list how long you’ve been at your current place of employment.

- Add your employer’s information and your monthly income.

- Choose your pay frequency, next pay date, and whether or not you have direct deposit.

- Type your bank’s account and routing numbers in the provided boxes.

- Review that all of the information you provided in the application is accurate.

- Submit the application for review.

Better Alternatives to Majestic Lake Financial

If you have any doubts or reservations about taking out a loan with Majestic Lake Financial, consider one of the alternatives listed below instead.

- Apply for a personal loan with a bank or credit union: You’ll find major banks and credit unions clearly post the terms associated with their personal loans, so you won’t be left wondering how much the loan will cost you or how long you’ll have to make payments to pay the loan back. Business Insider lists the current average personal loan interest rate as 9.63%, which is a far better deal than the triple-digit interest rates you’d get with a Majestic Lake Financial loan.

- Take out a 401(k) loan: As long as you follow the rules associated with 401(k) loans, you won’t be penalized on your taxes for borrowing money from your retirement plan. The best part is, you won’t be subjected to any credit checks and you’ll be paying yourself back instead of a lender.

- Cut unnecessary expenses: When emergencies arise, it’s time to cut back on non-essential expenses until you finish paying for the unexpected emergency. You may need to temporarily cancel your gym membership, cable subscription and your daily Starbucks purchase. You’ll also want to avoid eating out, going to the movies, or ordering new clothing until you’ve reached your financial goals.

- Request help from a local charity: If you need money to make a rent or utility payment, try contacting a few local charities in your area. Most are set up to help when times get tough. Churches also have benevolence funds to help members of the community with things like urgent car repairs and appliance replacements. Don’t forget to look into area food banks. If you don’t have to pay for food for a few weeks, you can use that money to cover your emergency expense.

- Obtain a credit card cash advance: Although credit cards charge a higher APR for cash advances than they do for purchases made with the card, this figure is still in the manageable lower double-digits. It doesn’t take long to get the cash advance from your credit card, as you’re already approved for a certain amount when you’re awarded the card.

- Cash advance apps: Download a cash advance app (Earnin is a good one) right to your smartphone. It’s free. These apps allow customers to get an advance on their next paycheck. Users usually aren’t charged any interest or fees, instead they ask customers to leave a “tip” for the service.