Are you struggling to keep up with two or more monthly debt payments? If so, then debt consolidation might be the right form of debt relief for you. But before you commit, you probably want to know: “How does debt consolidation work? When does it make sense?”

In the simplest of terms, it can replace multiple expensive monthly payments with a single, more affordable one. It’s a useful option for people who just need that little bit of extra breathing room to get back on their feet.

Here’s everything you need to know about the process to decide whether it makes sense for you.

Table of Contents

How Debt Consolidation Works

- Search for the lowest-interest loan you can find with favorable repayment terms.

- Complete the loan application process.

- Once approved, use the new low-interest loan to pay off your high-interest loans.

- Pay back the low-interest loan.

Use a debt consolidation calculator to figure out how much you could save.

When you apply for a debt consolidation loan, lenders will look at your credit report, credit history, income, debt-to-income ratio, credit utilization ratio and other financial details to determine interest rates, payment terms and lending amounts. Your credit score will matter. You’ll pay the highest interest rates if you have poor credit. You’ll get a better deal if you have fair credit and generally qualify for the best rates only if you have good credit.

If you can’t get a loan alone, qualifying will be more straightforward if you apply with a co-signer with good credit.

READ MORE: How to check your credit utilization ratio

Pro tip: Taking on new debt only works if you can also cut back spending. Debt consolidation won’t work if you consolidate your bills into one new loan and then max out your credit cards again.

READ MORE: Does debt consolidation close credit cards?

How to Use a New Loan to Consolidate Debt

Debt consolidation is relatively simple. Just follow these steps:

- Add up your monthly bills: Include such expenses as groceries, utility bills, transportation costs, credit card bills and any other loans you’re repaying each month.

- Calculate the loan amount you need: Add up all of the bills that can be consolidated, and figure out the loan amount you need. Be sure to account for any fees you may have to pay, including prepayment penalties.

- Learn your credit score: You can pull free copies of your credit reports at annualcreditreport.com.

- Research lenders: There are countless lenders, some of whom even focus on lending to borrowers with bad credit. Look for lenders with the best loan terms and interest rates for people in your credit score range.

- Prequalify: This will give you an idea of whether a lender will approve your loan application, and the interest rate you would have to pay.

- Compare loans: Once you’re prequalified, look at the loans that are available for you. Is the loan term long enough? Will the payment be manageable? Consolidation won’t work if you can’t afford your new loan payment.

- Complete a loan application: Once you’ve chosen the best loan option for you, complete the application and wait. Ideally, you will be approved and should have the funds within a week.

- Pay off your other loans: Make sure that all of your other loans are paid in full, and follow up the next month to ensure that there are no remaining interest charges.

- Make your new payments: Now you just have to make your single payment each month until your consolidation loan is paid off.

Types of Loans to Consolidate Debt

Several financial products can be used to consolidate debt. They include:

- Unsecured personal loans

- 401(k) loans

- Debt consolidation loans

- Balance transfer credit cards

- Home equity loan or home equity line of credit (HELOC)

- Reverse mortgage

- Cash-out refinance

READ MORE: Best debt consolidation loans

Example: Why Does Debt Consolidation Work?

Debt consolidation is effective because you can lower the amount of money you have to pay toward your debts each month. This frees up room in your monthly budget so that you don’t have to rely on credit cards to afford routine purchases.

Let’s take a look at an example.

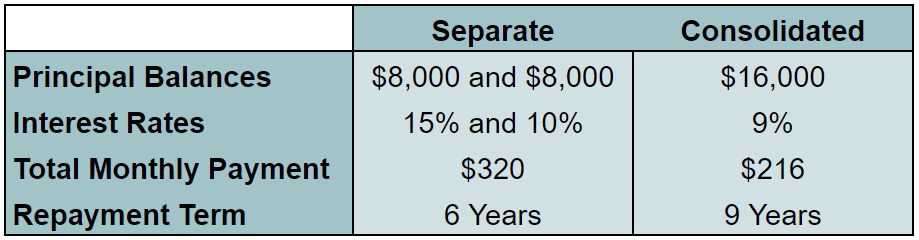

Imagine that John has $16,000 in debt. It’s split equally between his credit card and a personal loan with interest rates of 15% and 10%, respectively.

The personal loan term is six years, so John tries to keep that same pace while paying off the credit card. His monthly payments would be $170 for the credit card and $150 for the personal loan. That’s a total monthly debt expense of $320.

But then John loses one of his jobs and can’t keep up with his debt payments anymore. If he were to do nothing, he would start falling farther and farther behind on his debts, accumulating interest, and damaging his credit scores.

Before the problem gets worse, he shops around for a debt consolidation loan. Luckily, he’s able to find a lender willing to offer him a loan for $16,000 at 9% with a 9-year repayment term. The new monthly payment would be just $216 a month, creating over $100 in savings.

Some people would argue that this wasn’t a good deal because John will have to pay more in interest under the debt consolidation than he would have with the original loans. But that’s a false dichotomy.

The original loans were no longer viable because John wasn’t able to keep up with his payments. If he hadn’t gotten the consolidation, he would’ve missed his payments, racked up penalties and interest, and damaged his credit significantly in the process.

Debt Consolidation Methods

Debt consolidation is a form of debt relief that uses a new credit account to pay off several older ones. It effectively combines a borrower’s existing loans, credit cards, and monthly payments into one.

The new credit account is typically either a:

- Debt consolidation loan: These are generally low-interest installment loans. The initial lump sum pays off the old credit accounts then the borrower can pay back the new loan over the agreed-upon term.

- Balance transfer credit card: Borrowers can move all their outstanding balances to the new credit card, which usually has an introductory period of zero interest accrual. But after that period, interest will resume at a higher rate than with a consolidation loan.

It’s not easy to qualify for debt consolidation loans or balance transfer credit cards. Most lenders want to give these credit accounts to people with at least “fair” credit. If they can, people should always try for consolidation before falling behind on payments and damaging their credit scores.

That said, it’s not impossible to consolidate even with bad credit. Shop around before giving up on the strategy. Online lenders and credit unions are usually the best places to start.

Will Debt Consolidation Work for You?

Debt consolidation isn’t the perfect solution for everyone. It’s not the best idea for people who won’t have the income to keep up with payments even after reducing them with the consolidation. It also probably won’t help anyone who is looking to get out of debt faster.

But that doesn’t mean it’s not a useful strategy. It’s just a better tool for other circumstances. Consolidation is for people whose top priority is reducing their monthly payments to get a bit of breathing room.

It makes the most sense when all of the following are true:

- The borrower in question is struggling to keep up with monthly payments due to their number or size.

- Their income can cover the monthly payment under the new loan or card.

- Reducing monthly payments is more important to the borrower than the total interest cost of the loan.

- They have a budget in place that will keep them from running up more debt after the consolidation.

- The borrower has a credit score that will allow them to get a decent interest rate on their consolidation loan or a transfer card with a long introductory offer.

Pro tip: This might sound like a lot of limitations, but the truth is that every debt relief strategy is for a specific niche. There are pros and cons to each, and none of them are perfect solutions for every situation.

Debt consolidation is for lowering monthly payments. Even the convenience of reducing their number is secondary. People who can afford their payments could always use autopay.

For people who have other priorities, there are other forms of debt relief.

READ MORE: Ways to consolidate credit card debt

Consolidation vs. Other Forms of Debt Relief

Debt consolidation won’t work for everyone. If you don’t think it’s the right option for you, here are some other forms of debt relief to explore.

- Refinancing

- Credit Counseling

- Debt Management Plan (DMP)

Remember that there is no one-size-fits-all solution, and what provides good results for one person can easily backfire for someone else. Make sure to consider all of the options out there and understand their implications before committing to any strategy.

The Bottom Line

While you should try to meet your payments with less drastic means first (like budgeting or earning some extra cash), don’t hesitate to use a consolidation loan if necessary. Don’t wait too long. If your credit score starts to fall, it will be more difficult to qualify for a new loan.

Also, don’t fixate too much about the extra interest over the life of the loan. Debt consolidation can provide some much-needed breathing room when you know you’re not going to be able to make your payments, and that can keep your debt situation from spiraling out of control. Just make sure to carefully monitor your spending to ensure that you don’t continue to accrue debt.