If you need cash now and have bad credit, CreditCube might sound like a reasonable option.

But CreditCube is not a traditional lender. There are some additional risks you need to be aware of before you submit a loan application. The primary one is the high interest rates. You’ll likely pay an APR of more than 700%.

Here are the important facts about the lender.

Hot take: CreditCube offers short-term installment loans. However, the interest rates range from 159.90%-779.97% APR, which is very expensive, even more costly than a payday loan storefront lender would charge. They can do this (legally) because the lender is owned and operated by the Big Valley Band of Pomo Indians, granting them sovereign immunity that allows them to avoid state laws capping interest rates. Do not borrow money from a tribal lender unless you’re entirely out of other options.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What Is CreditCube?

CreditCube is an online tribal lender that provides small, high-interest loans of up to $5,000. Similar to traditional payday loans, the purpose is to offer people monetary relief due to an unexpected financial emergency.

CreditCube offers a quick application process, allowing the borrower to receive their money as quickly as the next day. Unlike typical payday loans, CreditCube allows borrowers to repay their loans over a few months instead of repaying in a lump sum from their next paycheck. Though this may appear to be a benefit, it only means more of your hard-earned money goes to the lender. CreditCube offers an APR of 159.90% to 779.97% on their loans, an astronomical number compared to credit card APRs, which max out at 36%.

Pro tip: The “lower” rates are only available to returning borrowers who become part of the CreditCube Loyalty Program. One example of the program’s “benefit” is that a $300 loan could drop its APR from 779.97% to 259.94% for a “VIP level” customer, but that “low” APR is still significantly higher than almost all other borrowing options.

CreditCube does not loan money to residents of Pennsylvania, Connecticut, Minnesota, New York, Vermont, Virginia, West Virginia and Georgia. The lender also states that “the availability of installment loans in your state is subject to change at any time with or without notice at the sole discretion of CreditCube.”

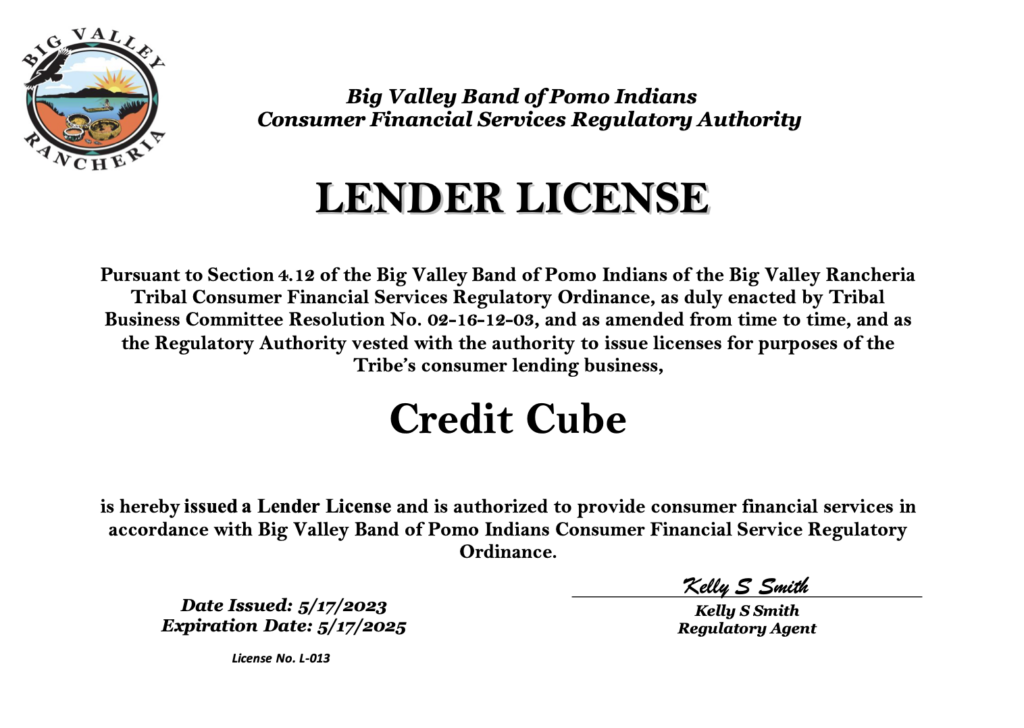

Is CreditCube Licensed?

CreditCube is not licensed by banking regulators in California, where they claim they are based, nor are they licensed at the federal level. At the bottom of their rates and terms page, you’ll find a link to this license from the tribe.

CreditCube is what is known as a tribal lender. The company is owned and operated by the Big Valley Band of Pomo Indians, a federally recognized American Indian tribe in the Lake County region of California. This means any agreement between CreditCube and the consumer is governed by tribal law, regardless of state laws in the state where the company or the consumer is located.

On the surface, this doesn’t sound like a big deal. However, the tribal loans they hand out almost always exploit consumers.

READ MORE: What is a tribal loan?

What to Expect When Taking Out a Loan from CreditCube

First-time borrowers can only take out a $200 to $400 loan with an interest rate near the higher end of CreditCube’s spectrum. Expect the APR to be 779.97% or higher on your first loan. Returning customers can borrow up to $5,000 with a “discounted” APR that is still typically higher than 250%.

In general, here’s what to expect when taking out a loan from CreditCube:

- An APR between 159.90% and 779.97%

- First-time borrowers can receive a loan between $200 to $400

- For returning customers, the maximum loan amount is $5,000, but the amount you qualify for varies based on your credit and repayment history with CreditCube as well as your Loyalty Program status

- Payments are typically due biweekly

- The standard repayment term will take months if the borrower only pays the minimum payment due. For example, a $300 loan at a 259.94% interest rate will take about seven months to repay at $38.34 every two weeks for a total of $536.76. That’s $236.76 in interest alone

- According to CreditCube, there are no penalties for paying off your loan early

- Additional fees of an undisclosed amount will be applied if you miss your payment due date. There is a $25 late fee if a payment fails due to insufficient funds or if your financial institution dishonors your payment.

These terms are consistent no matter the tribal lender, showing how expensive and dangerous working with them can be for borrowers.

Class Action Lawsuit

A class action lawsuit in Illinois alleges that CreditCube’s purported affiliation with the Big Valley Band of Pomo Indians is a façade (also known as a “rent-a-tribe” scheme), and non-tribal individuals use the tribal affiliation to issue loans that would otherwise be shielded from state usury laws.

According to classaction.org, the lawsuit says that CreditCube, CEO Ben G. Ray, III and payment processor North American Banking Company have “no colorable claim to sovereign immunity.”

The suit alleges loans with interest rates in excess of the state’s 9% rate cap are considered “void and unenforceable,” and loans that char 20% are a felony.

Although CreditCube claims to be “a wholly owned and operated business of the Big Valley Band of Pomo Indians of the Big Valley Rancheria,” a tribe with less than 700 members, at least 11 other internet lenders have operated out of the same 1,200-square-foot building at which the defendant claims to be headquartered.

Online Reputation

At first glance, they may seem like a reputable lending company, but once you dig a little deeper, the evidence is clear that CreditCube should be avoided in favor of cheaper and safer options.

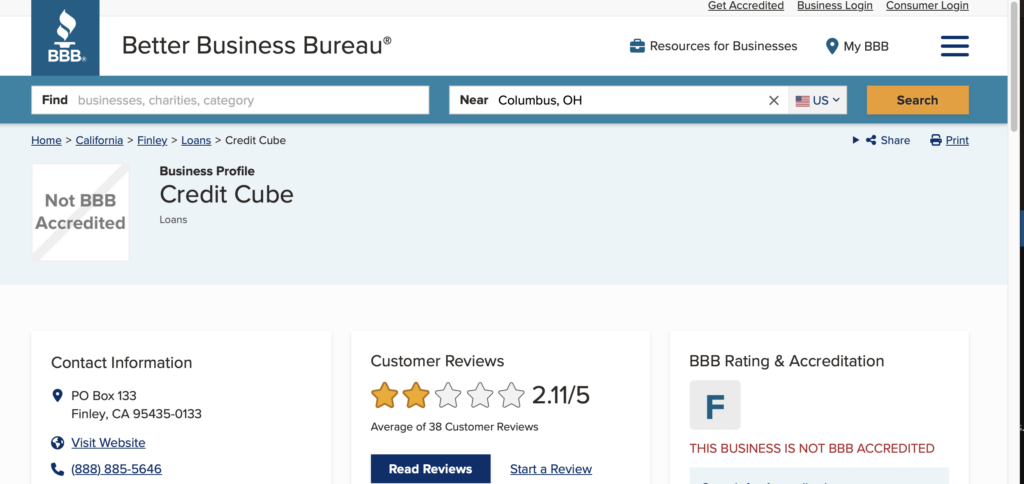

CreditCube has earned a 2.11/5 rating from customer reviews and an F grade on their Better Business Bureau (BBB) page.

The complaint section is littered with customers complaining about getting harassing calls and texts from CreditCube regarding their loans. Customers have also protested their agreements with CreditCube, claiming they are void due to the company not abiding by state laws where residents live.

For example, one customer wrote: I took out a … 600 dollar loan for Christmas and I cannot afford to pay this loan any longer due [to] financial reasons. I have paid the initial 600 back plus an additional 175.35. Can this be squared away because I cannot do this[?] In addition, it’s illegal to have [a] payday loan in the state of Georgia.

Tribal lenders will use “tribal immunity” as an excuse to ignore laws that are in place to protect consumers. They will not abide by laws in your state, nor are they legally required to follow those laws. Don’t assume that it will be easier to get out of a loan agreement just because it violates your state’s laws. Research the lenders before taking out the loan.

Consumers also gain points they can use toward getting a lower interest rate by giving testimonials for CreditCube. This can incentivize consumers into posting positive reviews of the company, whether or not they are deserved. Considering that anyone can leave a review on the page, some offer clues that they could be fake, with writing similar to the generic reviews featured on their website.

One customer gave a one-star review for his offer of a $400 loan at a 700% interest rate. It’s a typical example of the unreasonable rates CreditCube hands out.

Another customer complained about his $300 loan. He repaid $150 of the loan within two days and expected to owe two more payments of $98, but CreditCube told him he had three $98 payments remaining on a balance that was just under $100. The borrower paid the loan balance immediately, so he wouldn’t have to make the two extra payments. In a response, CreditCube blamed an error that caused the borrower’s $150 payment to be improperly recorded. It’s a good example of the importance of vigilantly monitoring your loan balances.

The Pros

CreditCube’s tribal payday loans are fraught with problems. Interest rates are through the roof, and shady business practices leave potential borrowers vulnerable to data breaches and more money lost than they ever thought possible for a small loan. Still, if you need money quickly and are confident you can pay it back immediately, here’s how you can benefit:

- Quick approval process without many hoops to jump through regarding credit score or other variables

- Fast payment: Get your loan as early as the next day

- It can be used immediately for a small financial emergency

The Cons

Taking out a loan with CreditCube can lead to a whole host of problems for you, including:

- Astronomically high interest rates: A $300 loan at a 779.97% interest rate will cost you over $1400 and take seven months to pay off if you only pay the minimum.

- Borrowers are not protected by state laws: Since CreditCube is a tribal lender, they don’t have to abide by the state laws where the borrower is located.

- Harassing calls and texts: Unfortunately, part of the application process means giving up this information, meaning the lender can contact you whenever they want.

- Shady business practices: These include undisclosed fees or terms that may be changed or added to your bill without your knowledge.

How to Apply for a Loan from CreditCube

Applying for a loan from Credit Cube only takes about 10 minutes as there are few qualification requirements. After clicking on the “Apply Now” button found on the homepage, you’ll need to fill out the following:

- Create an account, including email and password

- Provide your address, phone number and driver’s license number. Note that CreditCube will also ask for personal information like how long you’ve lived at your current address and if you own or rent

- Employer information such as name, location, and phone number

- Your monthly income

- When you receive your paycheck so they can sync up repayment dates

- Banking information including your bank account number and routing number

- Your Social Security Number and the desired loan amount

You’ll then need to agree to their terms of use and privacy policy before applying. You should hear back within a day or two, at which point you’ll be sent the terms of your agreement, including the loan amount and interest rate. All the information you provided must be entered without guarantee you’ll receive a loan from CreditCube.

Don’t start the application unless you’re 100% committed to completing it. CreditCube may use programs that track keystrokes on their website, allowing the company to gather your information even if you don’t actually submit a loan application.

Better Alternatives to CreditCube

Before you commit to a tribal loan, consider your options. If you really need a loan, there are much better online lenders. Lending Tree is a site that allows borrowers to shop for loans from reputable lenders. There, you can view side-by-side interest rates and loan terms, so you pick out the one that works the best for you. Best of all, interest rates are typically 36% or less for small loans, nowhere near the triple-digit figures on CreditCube.

Credit unions are another excellent place for borrowing money, especially if you need less than $1,000. Many credit unions offer Payday Alternative Loans with no minimum credit score requirement. PenFed Credit Union is a great starting point for borrowers as their services are available to anyone and are backed by the federal government.

Other methods you can utilize include:

- A paycheck advance app like Chime

- Peer-to-peer lending

- Borrowing from friends and family

- A credit card advance or low-interest balance transfer offer

- A home equity loan or home equity line of credit

- A loan from your 401(k)

The Bottom Line

Using CreditCube or any other tribal lender is an excellent way to get yourself into financial trouble. Not only are their interest rates extremely high, but their methods to extract money from you are borderline illegal. There are much safer (and better) option available to you if you need some fast cash. Don’t turn to CreditCube until you’ve exhausted all other options.

FAQs

You can reach CreditCube by phone at 1-888-885-5646 or email support@creditcube.com.

CreditCube is based in Finley, California.

CreditCube does not lend to residents of Pennsylvania, Connecticut, Minnesota, New York, Vermont, Virginia, West Virginia and Georgia.