Tens of millions of Americans have no credit record or a record too thin to generate a score. Millions more struggle with poor credit. If you have this problem, a credit-builder loan may help.

Understanding credit-builder loans will help you decide whether they are the right tool for you and which one to pick.

Disclaimer: Credit Summit may be affiliated with some of the companies mentioned in this article. Credit Summit may make money from advertisements, or when you contact a company through our platform.

Try Kovo if you want to give your credit the score you deserve.

Table of Contents

Best Credit-Builder Loans if You’re Looking for a Boost

We used several factors to compare lenders, including consumer reviews, loan terms and fund accessibility

| Lender | APR range | Loan amount | Payoff period |

| Self | 15.65% – 15.92% | $520 to $1,663 | 12 to 24 months |

| Credit Strong | 5.85% to 14.89% | Payments range from $15 to $110 a month | Up to five years |

| Money Lion | 5.99% to 29.99% | Up to $1,000 | 12 months |

| Fig Loans | 18.85% | $500 to $1,000 | 12 months |

| Philadelphia FCU | 4% | $250 to $1,000 | 12 to 18 months |

| Digital FCU | 5% | Up to $3,000 | 12 to 24 months |

| Alltru FCU | 12% | $300 to $1,000 | 12 to 24 months |

| Heartland Bank | Not disclosed | $500 to $1,500 | Not disclosed |

| Republic Bank | 5.419% to 8.055% | $500 to $1,500 | 12, 18 or 24 months |

| Sunrise Bank | 21% | From $500 | 12 to 18 months |

Read on to learn more about each program.

Best Overall: Self

Self offers credit-builder loans and a secured credit card that uses your credit-builder account as a security deposit.

Using Self is simple:

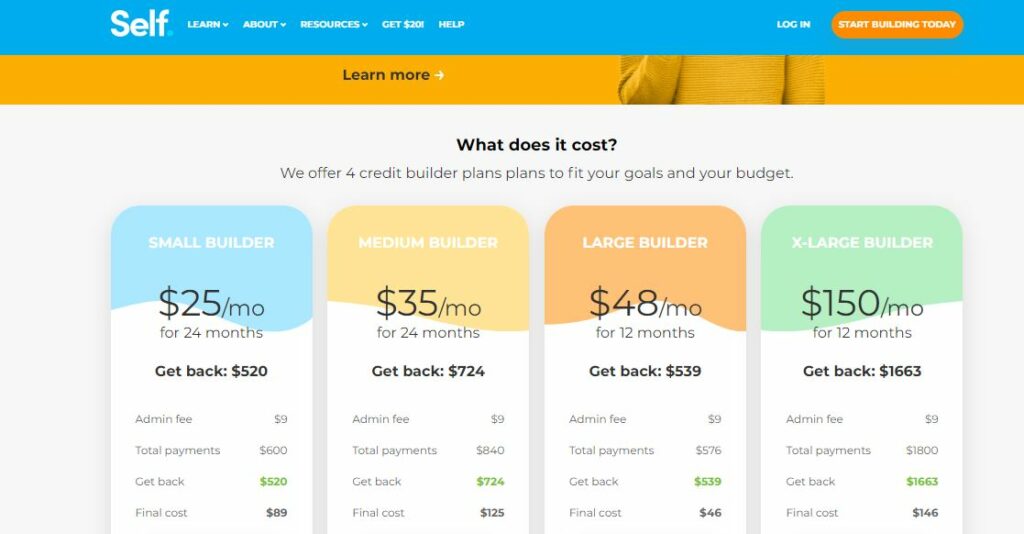

- Open your account by paying a one-time fee of $9. Self will perform a soft pull on your credit record.

- You choose a monthly payment, from $25 to $150.

- You pay for 12 to 24 months.

- Self reports to all three major credit bureaus.

- After $100 in payments, you can apply for the Self secured credit card.

- When your payments are complete, you receive the lump sum.

If you choose a $35/month payment, you will pay for 24 months. Your annual percentage rate (APR) will be between 15.65% and 15.92% and the total finance charge will be $125. At the end of the loan, you will receive $724.

Online Lenders

Several online lenders make credit-builder loans.

Credit Strong

Credit Strong offers seven plans with payments of $15 to $110 a month. Loan terms are up to 120 months. There is an administrative fee of $8.95 to $25, based on the plan. Loan APRs range from 5.85% to 14.89%, depending on the plan. You’ll get free access to your FICO 8 score. You will need the requirements cited above plus a mobile phone number with a Google Voice account. Credit Strong is not available in Vermont or Wisconsin.

MoneyLion

MoneyLion is a mobile banking app that offers Credit-Builder Plus, a credit-builder loan. You can borrow up to $1,000 and pay in up to 12 months in weekly, biweekly, or monthly installments. You will pay a $19.99 monthly membership fee, making this a fairly expensive option. Your credit record has a soft pull, but you can apply without a credit score.

Fig Loans

Fig Loan is an alternative to storefront or online payday loans that helps borrowers build credit. A $1,000 loan over 12 months would mean a monthly payment of $85, and would have an APR of 18.85%. At the end of the loan term, you’d get $1,000 back. Fig Loans’ credit-builder loans are not available in every state.

You may find other online lenders. Always check their terms and their reputation!

Credit Unions

Several national credit unions offer credit-builder loans.

- Philadelphia Federal Credit Union offers credit-builder loans from $250 to $1,000 with terms of 12 to 18 months. The APR is only 4%.

- Digital Federal Credit Union offers credit-builder loans nationwide. You can borrow up to $3,000 with a loan term of 12 to 24 months and a fixed APR of 5%.

- Alltru Credit Union will refund for 50% of the interest you pay over the life of the loan. The APR is 12%. Alltru offers 12-month loans ranging from $300 to $1,000.

Many credit unions offer loans within specific regions. Search online for options in your area. You will usually need to join a credit union to get a credit-builder loan.

Banks

Several traditional online financial institutions offer credit-builder loans.

- Heartland Bank offers credit-builder loans from $500-$1,500. You will need 6 months of verified income and you will need to complete a financial education class and pay a $25 fee. Heartland does not disclose loan terms or interest rates.

- Republic Bank offers credit-builder loans of $500-$1,500 with terms of 12, 18, or 24 months. The APR varies from 5.419% to 8.055%, according to the terms you select. There is a $10 processing fee.

- Sunrise Bank offers 12-month and 18-month loans. In each case, the monthly payment will be about $50, The APR is around 21% for the 12-month loan and 15% for the 18-month loan.

Always review loan terms carefully, and read the fine print!

Your Bank or Credit Union

It’s always worth asking your own bank or credit union about credit-builder loans. Community banks know your finances and they are in a good position to assess the best way for you to build credit. Using your own bank makes it easy to set up payments.

What is a Credit-Builder Loan?

A credit-builder loan is an installment loan that is designed to help the borrower build credit.

Credit-builder loans are unique because a borrower pays the lender in monthly installments and then, at the end of the loan term, receives the money in a savings account. They’re considered secured loans because the bank deposits money on your behalf.

Credit-builder loans help borrowers build credit, but also can help them save money. It’s like opening a traditional savings account, but the difference is that borrowers pay interest to the lenders, and there may be an upfront fee to open an account.

When a lender makes a conventional loan, they are taking a risk. You might not pay the loan. They will end up selling the account to a collection agency for pennies on the dollar, and they will lose money.

A credit-builder loan presents little or no risk to the lender, so they can offer these loans to people with poor credit or no credit

Credit-builder loans may be offered by other names, like “Starting Over Loans” or “Fresh Start Loans”.

READ MORE: Which credit bureau, report or score is most accurate?

How Does a Credit-Builder Loan Work?

When you use a credit-builder loan, you don’t get the money until the loan is paid. Here’s how it works.

- You apply for a credit-builder loan.

- The lender places the amount in a locked savings account or certificate of deposit.

- You make monthly payments, which helps you build a positive payment history.

- The lender reports the loan and your payments to the credit bureaus: Equifax, Experian and TransUnion.

- When the loan balance is paid, the lender gives you the money, minus interest and fees.

There are additional features that make these loans ideal for building credit.

- Many credit-builder loans are for relatively small amounts, often under $1000.

- Loan terms vary, often from six months to six years.

- Monthly payments are usually small. That helps you make payments on time.

If you make your payments on time, your loan helps you boost your credit score.

Does a Credit-Builder Loan Require a Credit Check?

Different lenders have different policies. They will fall into one of three categories.

- No credit check. Some credit-builder loans require no credit check at all.

- A soft pull. Some lenders may perform a “soft pull” on your credit report, which does not affect your credit.

- A hard pull. If a lender makes a “hard pull” they will view your entire credit report. A hard pull ican temporarily reduce your score.

If a lender does check your credit, the required score is usually low. These loans are designed for people with poor credit who might otherwise be forced to take out a payday loan.

What Are the Other Requirements for a Credit-Builder Loan?

These are the most common requirements for a credit-builder loan.

- You will have to be 18 or above.

- A Social Security number will be required.

- You will need to be a US citizen or permanent resident with a US address.

- You’ll need a bank account, debit card, or prepaid card to make payments.

- Proof of sufficient income to make your payments.

Some lenders may have additional requirements.

Do Credit-Builder Loans Work?

Credit-builder loans are designed to help borrowers improve their credit. Do they achieve that purpose?

In 2020 the Consumer Financial Protection Bureau undertook a study of credit-builder loan outcomes. There were two key findings.

- Opening a credit-builder loan can boost scores by 60 points for borrowers without existing credit.

- Participants with existing debt saw an average credit score decrease of around 3 points. This happened because many participants with existing debt missed payments on their credit-builder loans or other loans.

Credit-builder loans work if you make every payment on time and if you continue to make on-time payments on any other credit accounts. If you miss payments, the loan will hurt your credit.

The same is true of every other financial product designed to help build credit.

READ MORE: Is no credit better than bad credit?

Pros and Cons of a Credit-Builder Loan

Like every method of building credit, a credit-builder loan has advantages and disadvantages.

Pros

- Credit-builder loans have easy requirements.

- Repayment is simple, and monthly payments are typically small.

- You receive a lump sum when the loan is paid.

- Improving your credit score opens new financial options, including better interest rates, access to credit cards and the potential to qualify for a higher credit limit,

Cons

- You will pay interest and you may pay fees.

- Payments may interfere with your ability to pay other debts.

- If you make late payments on your credit-builder loan or other debts, your credit will be harmed.

A credit-builder loan can help build credit, but you’ll need to decide whether it’s the best way for you to build credit.

How Will a Credit-Builder Loan Affect My Credit Score?

A credit-builder loan helps your credit in three ways.

- On-time payments will establish a good payment history. Payment history is the most important component of your credit score.

- A credit-builder loan is an installment loan. This will help you build your credit mix, especially if you already have a credit card.

- As your loan ages it will build the length of your credit history.

It’s important to remember your credit mix. If you already have a secured credit card, a credit-builder loan will expand your credit mix and help your credit.

Other Ways to Build Credit

If you already have an installment loan in your record (a student loan or auto loan, for example) you might be better off adding a form of revolving credit, like a secured credit card. Try these options:

- DiscoverIt Secured (no annual fee)

- OpenSky Secured Credit Card (no credit check)

- Petal1 Credit Card (approval based on banking history, not credit score)

All of these are solid ways to add revolving credit to your record.

You can also ask a credit card user with good credit to add you as an authorized user. Even if you don’t make purchases, you will have revolving credit on your record. Just be sure the issuer reports authorized users to the credit bureaus.

READ MORE: Do subscriptions like Netflix and Hulu build credit?

Want to learn more about building your credit? Here are a few ways to help build your credit from scratch:

The Bottom Line

Building better credit will help you in many ways. You’ll have access to better loans and credit cards at better interest rates. Purchases like a car or a home become more accessible. Even landlords and potential employers will treat you better.

Building credit takes work, but you can do it. Start by understanding how your credit score is generated and learning how to read your credit reports. Take charge of your spending and your borrowing and you won’t just build better credit, you’ll improve your entire financial life.

A credit-builder loan can be a great place to start.

FAQs

Three costs are associated with a credit-builder loan: fees, interest and your monthly payment. All three vary with the terms of the loan you select. Always compare lenders!

Credit-builder loans are designed for people with no credit or poor credit. Requirements are low, and some loans are available without a credit check.

A credit-builder loan can boost your credit score. You will have to make your loan payments on time and make sure that you keep up with your payments on any other credit you may have.

Credit-builder loans are available from many local and national banks, credit unions and online lenders. Try Self, Credit Strong, Philadelphia Federal Credit Union or Digital Federal Credit Union.

Kikoff is a credit-builder service. You pay $5 a month for access to “Kikoff Credit,” which you can use for items in the Kikoff store, which in turn helps you build credit. If you’ve already signed up for Kikoff, membership also includes a credit-builder loan. Kikoff will deduct $10 from your bank account each month, and at the end of the year will repay you $120. Read a full review of Kikoff.