For many consumers, a short-term cash advance loan may seem like the answer to their financial struggles. But with high interest rates and predatory practices, you should take great caution before considering a loan from Cash Advance Now.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Cash Advance Now?

Established in 2012, Cash Advance Now is a tribal lender owned and operated by Great Plains Finance, LLC. The company offers fast, convenient financial assistance in the form of payday loans. Although these loans are meant to act as a temporary bandage to a current financial struggle, they come with their share of problems.

For many borrowers, getting a payday loan is the start of a vicious cycle of debt. In fact, 80% of all payday loans are taken out less than two weeks after the previous loan was paid off. Sometimes, the new loan is used to help cover the remaining balance of the previous loan. One of the biggest reasons for this is the small borrowing limit combined with unreasonably high interest. Many borrowers are unable to pay back their initial loan as a result of the terms.

While Cash Advance Now’s pay-over-time system is accessible to consumers, it comes with a hefty price. For context, here’s an example from the lender’s website:

- $300 initial loan paid in 12 installments over 6 months with 725.00% interest.

- Each installment amount is $88.27.

- Total accrued interest is $759.04.

- The total amount paid for the loan is $1,059.04.

Although Cash Advance Now is transparent with its terms and conditions, this lending model takes advantage of consumers in need of a quick financial solution. If you’re thinking of getting a payday loan through this lender, here’s everything you need to know.

Is Cash Advance Now Licensed?

In short, no. Cash Advance Now complies with federal and tribal law, but it is not licensed. Instead, Cash Advance Now claims sovereign immunity under the Fort Belknap Indian Tribe of Montana. This means a couple of things.

- The lender has the right to sue any borrower who defaults on their loan, but the borrower cannot take them to court or sue them because of tribal protection.

- Although no license usually means the terms of a loan cannot be enforced and the money cannot be collected, Cash Advance Now bypasses this due to the protection offered by the tribe.

- Borrowers do so at their own risk as they have little protection if they miss payments or default on their loan.

Ultimately, it’s important to read the fine print and establish a personal financial plan before doing business with a lender like Cash Advance Now. This will help prepare the borrower and minimize any long-term damages.

Typical Loan Terms of Loans from Cash Advance Now

In some ways, Cash Advance Loans are standard for payday loans. This includes things like eligibility and loan amount. However, because they are a tribal lender operating under tribal laws, certain terms and conditions are different. The terms are also subject to change but, as of the date of this post, they are as follows:

- U.S. citizens who are 18 years old or older are eligible to apply.

- No credit score is required, though the lender may perform a credit check.

- All borrowers must have an active checking account at least 90 days old.

- It is required to verify consistent employment for the past 90+ days with a current employer.

- All borrowers must make a minimum of $900 each month.

- Loans are offered in installment plans with (mostly) equal payments spread out over an agreed-upon term. Late payments are subject to a fee.

- Eligible borrowers can receive between $300 and $1,500. First-time customers are limited to a maximum of $500.

- Payment dates can be changed with advanced notice and at the discretion of the lender.

- There is no prepayment fee, meaning borrowers can make payments early or in higher amounts than initially agreed upon.

Overall, the lender is upfront with their rates and discloses key information to potential customers.

Online Reputation

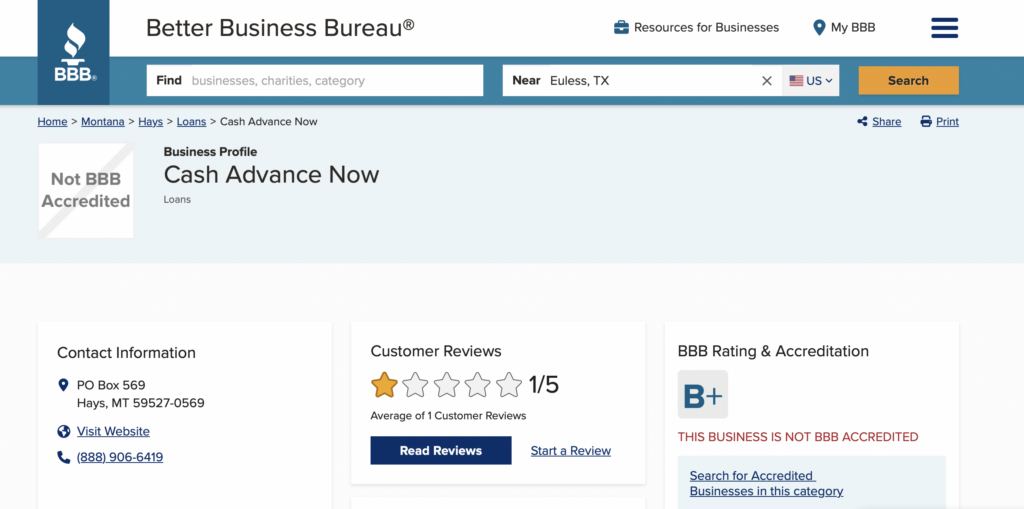

On BBB.org, Cash Advance Now has received seven complaints, most involving difficulty repaying the loans.

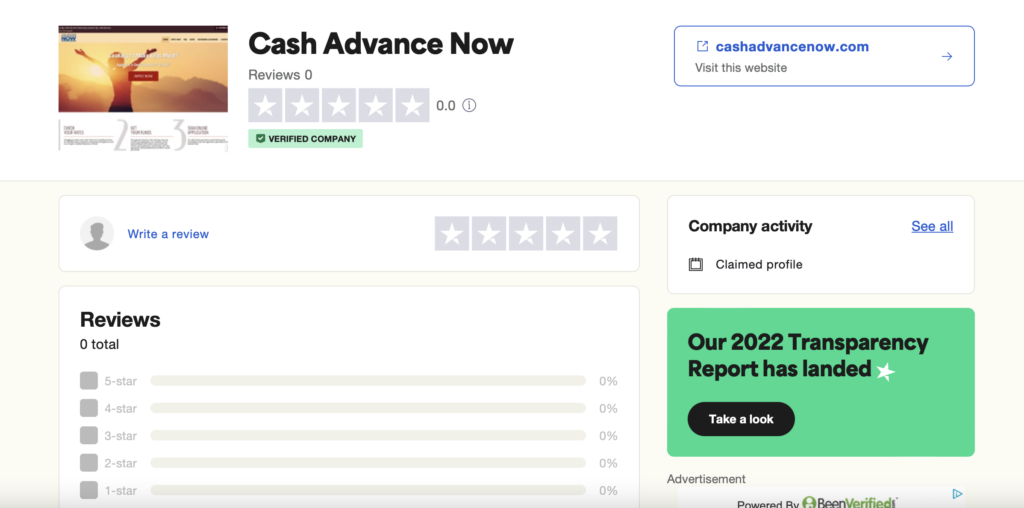

On Trustpilot, there are no reviews.

However, the company that operates Cash Advance Now, GreatPlains Finance, LLC has been reviewed 1,343 times with an “average” rating. That said, some consumers complain about account closures due to late payments. Others suggest the company is a scam. Other common complaints involve changing bank accounts, sky-high interest rates, prerecorded messages and slow response times.

For the most part, the company appears to honor its agreements but has notable flaws in its lending practice.

Pros

- Easy, secure application and preapproval through secure SSL server.

- No credit check or hard inquiries.

- No prepayment or early payoff fees.

- Easy repayment options.

- Transparency regarding loan terms and rates.

- Quick availability of funds in the customer’s bank account (usually within one business day).

- 24/7 online support with regular business hours for phone calls.

- Ability to repay the loan in installments over several weeks or months.

Cons

- Online-only lender so no physical locations.

- Not available to borrowers in Arizona, Maryland, Montana, New York, Pennsylvania, Virginia or West Virginia.

- Does not report to the credit bureaus, so on-time payments will not improve the consumer’s credit score.

- Late payments or defaulting on a loan may result in the lender reporting it to the credit bureaus or sending the account to collections, which can hurt the borrower’s credit.

- Late payment fees are up to 10% of the missed payment amount.

- High interest rates for loans (725% APR and up).

- The lender follows tribal law, rather than state law. It is not licensed or BBB-accredited.

- Automatic withdrawals from the linked bank account.

Better Alternatives to Cash Advance Now

Whether or not Cash Advance Now is a reputable company, the main problem lies in the nature of the loan itself. Luckily, there are other options out there for those who need cash quickly.

- Credit cards for borrowers with bad credit: These credit cards often have higher interest rates (up to 35%) than other credit cards, but they are much lower than payday loans. The initial credit limit is often around $300 or $500 with the chance to increase it with good payment history. Credit card lenders usually report to at least one credit bureau, meaning borrowers with poor credit can improve their score over time.

- Payday Alternative Loan: Less costly in the long term for borrowers, payday alternative loans (PALs) are offered by credit unions. They are a good alternative to traditional payday loans. They are limited to a maximum APR of 28% and can be paid in installments over one to 6 months.

- Unsecured personal loan: Financial institutions and companies like SoFi or Wells Fargo offer unsecured personal loans with lower APR (usually around 10% to $36%) for borrowers. Although some of these loans have a prepayment penalty, they can be beneficial towards building credit and short-term financial gain. Many lenders offer them in larger amounts starting from a few thousand dollars and up.

- Cash advance apps: Cash advance apps, also sometimes known as payday advance apps, are a popular service. These apps provide almost instant cash, giving the user access to money they’ve already earned but haven’t yet received from their upcoming paycheck. Most cash advance apps are free to use, though some charge a small membership or monthly fee. Unlike many lenders, very few cash advance apps charge interest or loan origination fees. And there are plenty of options available.

The Bottom Line

Before applying for any loan, always carefully consider the company’s terms, conditions and reputation first. This can save you a lot of long-term financial hardship and grief.

FAQS

You can reach Cash Advance Now by phone at (888) 906-6423 or by email at support@can-lending.com.

Cash Advance Now is based in Hays, Montana.

Cash Advance Now does not lend to residents of Arkansas, Connecticut, Maryland, Montana, New York, Pennsylvania, Virginia or West Virginia