Taking out a Bright Lending loan can lead to a not-so-bright future.

Many lenders are set up to provide loans to individuals who find themselves in a jam. Bright Lending is one such lender; however, this company charges exorbitant interest rates. Before you sign on the dotted line, you’ll want to check out this review.

Featured Alternative: DebtHammer

- Break the borrowing cycle

- Can help with many types of debt, including payday and tribal loans

- Friendly and helpful customer support – no judgment

Table of Contents

What is Bright Lending?

Bright Lending, also known as Aaniiih Nakoda Finance, LLC DBA Bright Lending, is located in Hays, Mont. It’s a tribal lender, which means the company is solely owned by a federally-recognized American Indian tribe. In this case, that tribe is the Fort Belknap Indian Community of the Fort Belknap Reservation of Montana.

The company, which got its start within the last five years, offers short-term personal loans that have high interest rates that are almost double that of traditional payday loans. In fact, the Federal Reserve Bank of St. Louis lists the average payday loan interest rate as 391%. Bright Lending’s interest rate for new customers is an astounding 725%! If you’re willing to sign up for automatic payments, the company lowers the interest rate to 700%, which is still 309% higher than an average payday loan.

Do you have more than $500 in payday debt?

We help you fight lenders like Bright Lending. You might be able to reduce your loan amount by up to 80%.

Is Bright Lending Licensed?

Since Bright Lending is a tribal lender, they are not required to be licensed in the state of Montana. According to Finder, although Montana does allow payday-type loans, they cap the interest rate companies can charge customers at 36%. Bright Lending does not follow the state’s laws, as they get around these laws by operating on tribal land.

You’ll find that Bright Lending lists itself as a licensed lender authorized by the Tribe’s Tribal Regulatory Authority (not the same as a state license). This type of system is flawed, as there are no checks and balances.

On a more positive note, the company also boasts that it is a member of the Online Lender’s Alliance, which requires members to follow a set of best practices. The Online Lender’s Alliance does have a set of checks and balances, as it provides consumers with a special hotline to make complaints or report fraud. The OLA Consumer Hotline phone number is 1-866-299-7585. Consumers also have the option of sending an email to complaints@oladc.org.

READ MORE: About tribal loans and tribal lenders to avoid

Typical Loan Terms of Loans from Bright Lending

Just like other personal loans on the market, Bright Lending allows borrowers to use the funds for just about any purpose. This includes taking a trip to visit a sick loved one, catching up on a delinquent electric bill and paying for the family pet to have a much-needed surgery. Unlike other personal loans, Bright Lending charges an astronomical interest rate, significantly increasing the total amount of the loan.

Below are some terms you’ll find when taking out a personal loan with Bright Lending:

- Loans range between $300 and $1,000.

- Loan term is 10 months, no matter how much you borrow.

- Payment schedules are created based on the individual’s pay cycle.

- Choice between manual or automatic payments.

- 700% to 725% APR for new customers.

- 500% to 625% APR for returning customers.

- Late charges occur after accounts are five days past due. This charge is equal to 10% of the payment due.

- Non-sufficient funds/returned item fee of $30.

- No collateral required.

READ MORE: Reputable payday lenders and alternatives

Online Reputation

It’s always good practice to search the web for customer reviews before taking out a loan with a company you know little about. The Better Business Bureau’s (BBB) website is a good starting point.

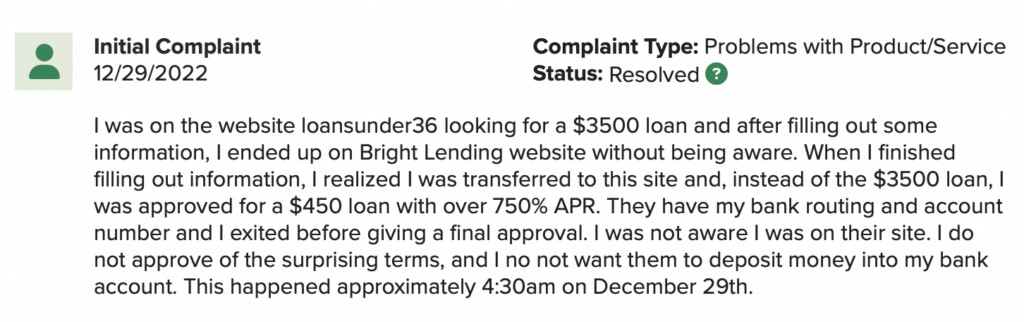

Currently, the BBB has an alert issued for Bright Lending. The alert reads, “Better Business Bureau recognized a pattern of complaints from consumers regarding the lending practices of Bright Lending.” Following this alert, the BBB reported not hearing back from Bright Lending after reaching out to them a month prior. Bright Lending is listed as not accredited with the BBB and has a grade of a B and a customer rating of one star out of five stars.

Customers report that the loans are keeping them in a vicious debt cycle, that the payment withdrawal dates they selected were not being honored, and that customer service is difficult to deal with.

At Ripoff Report you’ll find a handful of reports that seem to echo what the BBB reviewers reported. One discusses the company’s unwillingness to change the payment date when the customer switched jobs. Another warns about the 700% APR, which makes it almost impossible for some to pay the loan off.

Scamion allows reviewers to post and carry on a conversation about a company. One Bright Lending borrower commented that they believed they were almost finished paying off their loan, only to discover that they still had to make 30 more payments. A commenter chimed in stating that they received a loan quote from Bright Lending that had a $2,162 interest charge for a $500 loan. Fortunately, the commenter realized these terms were outrageous and never went through with the loan.

READ MORE: Payday loans vs. installment loans — what’s the difference?

Pros of a Bright Lending Loan

- Easy to apply via the company’s website.

- Funding as quick as one business day.

- No prepayment penalties.

- Slight discount when signing up for automatic payments.

Cons of a Bright Lending Loan

- Highest interest rates out there.

- Late fees.

- Insufficient funds fees.

- Low loan amounts.

- Not available in all states and U.S. territories.

READ MORE: Payday loan organizations — help and alternatives for victims

How to Apply for a Bright Lending Loan

In the event that you wish to go ahead and apply for a loan with Bright Lending, you’ll need to click the yellow “Appy Now” button on the company’s homepage. Follow the prompts to fill in your personal information, which will include inputting your social security number. Next, you’ll need to tell the company about your financials. This includes whether you rent or own a home, your income information, and your checking or savings account information. Once you submit the application, the company will review the details you provided before issuing you an offer.

Before you accept any offer for a loan from Bright Lending, make sure you read the entire contract. Make sure you fully understand the principal amount borrowed and how much you’re paying in total interest when all is said and done. If the company requires you to make 22 $100 payments, stop and do the math. That comes out to $2,200 total, which is a great deal if you’re only borrowing $600. Ask yourself if you’re willing to agree to those payments, as you’ll legally be required to pay the money back once you sign the contract and receive the funds.

READ MORE: 15 ways to get out of payday loans for good

Better Alternatives to Bright Lending

Although it may be easy to apply and receive a Bright Lending loan, it’s not the best option on the market due to its extremely high interest rates. There are plenty of other alternatives that will help you meet your pressing financial needs.

- Cash advance apps: Download a cash advance app (Earnin is a good one) right to your smartphone. It’s free. These apps allow customers to get an advance on their next paycheck. Users usually aren’t charged any interest or fees, instead they ask customers to leave a “tip” for the service.

- NetCredit: Borrowers can apply for a loan of $10,000 with terms of up to 60 months. The loan’s APR is still high (34.99% to 99.99%); however, it’s nowhere near what you see with Bright Lending.

- Pawn shop loan: If you live within driving distance of a pawn shop, you’ll want to consider taking out a pawn shop loan. All you need is a valuable item that you are willing to use as collateral. The pawn shop will offer you loan based on what the item is worth. As long as you pay the pawn broker back by the due date in the contract, you’ll get your item back.

- Credit card cash advance: A certain amount of your approved credit limit can be used for a cash advance. It’s important to note that the cash advance interest rate is different from the card’s purchasing interest rate, so be sure to check your card’s terms. The Discover It card, for example, has a 24.99% APR on cash advances, which is a much better choice than Bright Lending’s 700% APR.

- Peer-to-peer lending: Reputable peer-to-peer lending sites, like Lending Club and Peerform, are worth a look. They allow borrowers to request a loan directly from an investor, instead of a bank or credit union. Interest rates vary based on a person’s credit rating, but in general are very reasonable.

- Local charities: Almost every community has a list of local charities that you can contact to help meet your pressing financial needs. These include food banks, utility assistance programs, rental assistance, charity care for hospital bills and church benevolence programs.

The Bottom Line

Borrowing from Bright Lending doesn’t seem like a particularly bright idea, given the number of customer complaints and problems. Instead, explore some alternatives, including reputable online lenders like Upstart, Upgrade and OneMain Financial.