In 2021, the credit repair industry in the United States was worth $3.4 billion. Around one-third of all American consumers have found at least one error on their credit report. The errors can range from simple misspellings to incorrectly reported bankruptcies.

Some errors can bring your entire credit score down, thus making it difficult to qualify for financing, apartment rentals, and even certain jobs. Fortunately, the best credit repair software and companies can help.

Table of Contents

Best Personal Credit Repair Software Programs

Credit repair software programs can identify errors on your credit report and create dispute letters for the removal of those errors. They can also help you determine the best way of handling your debts and make it easier to build or repair credit.

Software is often cheaper than credit repair services, but no less effective. With that in mind, here are the best personal credit repair software programs.

Credit Repair Cloud

Previously known as Credit-Aid, Credit Repair Cloud is best for people who already have some personal experience with credit repair. It’s also good for entrepreneurs who want to get into the credit repair business or add to their revenue streams.

This credit repair software features:

- Tools to add team members to an existing credit repair business

- Ways to help your clients rebuild their credit

- 30-day free trial with free cancellation

- Easy, all-in-one system

- Resources to build a credit repair business even without prior experience

- Training to get new revenue streams

- User-friendly dashboard

- Hundreds of dispute letter templates

- Exclusive private community and free training (with purchase)

- No startup fees, hidden fees, or contracts

- 20% discount on the annual package

- Convenient way to add clients to your business, import their credit reports, and create credit audits

There are four pricing levels ranging from $179 to $599. Each plan includes:

- Dispute letters

- KPI business dashboard

- 2 months’ free web hosting

- Client and lead importing from other software

- Credit auditing

- CRM for the sales team

- Batch printing

- Credit repair training

- Full support from start to launch.

Add-ons include 14-day credit repair business start-up training, fast track roadmap to business success, and credit repair course certifications.

Experian Boost

Offered by Experian, Experian Boost is not technically software that rebuilds credit. It’s a free service designed to help you boost credit through non-traditional methods. For example, you can get credit for regularly paying for monthly subscriptions like Netflix and Hulu. It can be a simple (and free) way to rebuild credit. The average user’s credit score improves by 13 points with it. It has the following features:

- Easy access to your Experian credit report and score

- Credit monitoring and alerts

- Option to link non-traditional accounts (ex. phone, utility, or certain streaming services) and have them reported to Experian

This service is best for people with no or poor credit who want to increase their score through Experian quickly, or for people who don’t have the time or technical know-how to deal with dedicated software systems. It only reports positive payment history on your connected accounts. To use it, you must connect the bank account you use to pay for any accounts.

DisputeBee

DisputeBee is a credit repair software designed for anyone, including novices and professionals. Key features include:

- Automated error dispute process from beginning to end

- Educational information about credit repair and consumer laws like the Fair Credit Reporting Act (FCRA)

- Dozens of letter templates

- User dashboard so you can keep track of all disputes, letters, creditors, etc.

- Free cancellation

The two plans are:

- Individual Plan: This plan lets you import your credit report and includes prewritten letter templates, a dispute process tracker. It can dispute anything from late payments and hard inquiries to accounts in collections and bankruptcies. It costs $39 a month.

- Business Plan: This plan includes all of the above plus unlimited team members and clients, advanced dispute strategies, bulk letters, custom letter templates and sequences, a client portal, and client billing integration. It costs $99 a month.

Once you choose the right plan for you, simply follow the software’s guide to importing your credit report. Then, the software will generate dispute letters based on your report. You can then send those letters to credit bureaus, lenders, banks, or debt collectors.

Each time you receive a response, upload it to the software for convenient monitoring. If the error is not immediately resolved, the software will continue generating letters until it is.

Personal Credit Builder

Also known as Personal Credit Software, this automated software helps streamline the dispute process by giving average users professional tools for DIY credit repair. It’s available for individuals and industry professionals (finance and real estate) who want to attract prospects or diversify their revenue streams. It features:

- Auto-populated dispute letters for bankruptcies, foreclosures, repossessions, tax liens, charge-offs, judgments, collections, late payments, identity theft, and fraud on all credit reports

- Tools to help you manage your finances and improve your credit in the long run

- Help with creating a customized personal budget

- Bonuses and educational resources like credit repair tips, legal tips, and pro strategies

- Up to 3 users at a time

- Compatibility with Microsoft Windows 7, 8, and 10

This DIY personal credit software normally costs $399.97, but is currently discounted at $199.97. Unlike other credit repair software, this is a one-time fee, meaning there are no monthly charges. However, there is no free trial or moneyback guarantee.

The way Personal Credit Builder works is simple. After purchasing it, import all three of your credit reports with one click and let it auto-generate dispute letters. Many users see results within 30 days after sending the first letter.

Turnscor

Turnscor encourages long-term credit repair and maintenance so that people can avoid many of the common pitfalls of credit in the future. It’s best for people who want to improve their credit over months or years. With it, you can find:

- Pro strategies on identifying and resolving errors with your creditors and the bureaus

- Credit education resources to manage and keep your credit healthy, as well as to prevent further issues

- Credit repair tools and fraud prevention tactics

- Budgeting tools

- Free eBook with a step-by-step guide to credit management

- Several methods of learning about credit repair, including eBooks and videos

- Option to consult with an in-house attorney for legal advice on improving credit

- 60-day moneyback guarantee

- Spanish and English versions

This credit repair software also focuses on making sure creditors and the reporting bureaus comply with the Fair Credit Reporting Act laws.

It costs up to $495 per person for a full year. If you choose to renew the software, you can do so at half the usual price.

Credit Detailer

Built for individual and professional use, Credit Detailer is an intuitive software that’s ideal for both DIY credit repair and small business owners to use with their clients. The standard package features:

- Credit Detailer Business Edition Software (download only)

- Professional credit repair strategies used by professionals

- Credit education on consumer rights and links to resources through the FCRA, FDCPA, FCBA, etc.

- Lifetime license on one computer

- Unlimited number of disputes on anything on your report, including bankruptcy, collections, repossessions, late payments, and charge-offs

- Free software updates for the first year

- No mandatory renewal fees

- Installation support

- Everything you need to launch a credit repair service business, including unlimited clients and credit lines (with the Business Edition)

- Up to 2 users on the Personal Edition

- English and Spanish customer service, contracts, and screen captions for individual users

- Free 7-day trial using your email and the code on their website

- 30-day full refund

Currently, the standard package (Business and Personal) has a one-time fee of $399. However, bundles can go up to $1,299.99, depending on what’s included.

For more options, you can get a bundle. These include things like:

- Professional coaching from a credit expert (the amount of time depends on the bundle)

- Access to an online portal

- Private label

- Distribution rights

- Live tech support

- Up to 3 years’ software maintenance

Credit Detailer also partners with The Credit Coach, a credit repair firm that can provide more direct assistance to those who need it.

TurboDispute

TurboDispute offers a cloud-based system and a home edition called Turbo Score. Both are intuitive software that offer a long-term solution to credit repair and debt management. Whichever you choose, you can tackle anything from late payments to hard inquiries to tax liens.

It includes:

- Guidance on obtaining free credit reports from all three bureaus

- Dispute letters and debt settlement letters written by attorneys

- Insider tips on credit repair

- Progress tracking via charts and graphs

- Help dealing with creditors

- Video tutorials

- Step-by-step guide to credit repair and debt management

- Lifetime free updates

- 60-day moneyback guarantee

This software isn’t as automated as others, but it’s affordable at just $39.95.

Credit Coach Pros

Credit Coach is best for individual use and offers the following:

- Help removing negative items such as outdated information, charge-offs, bankruptcies, and late payments

- Credit analysis

- Live assistance

- Thorough guide to creating a personal plan to handle personal finances

- Help with finding the best rates on loan products

This software is available nationwide and costs $299 for one user or about $450 for two users each month.

Best Credit Repair Business Software for Entrepreneurs

Here’s the best credit repair software for small businesses or entrepreneurs.

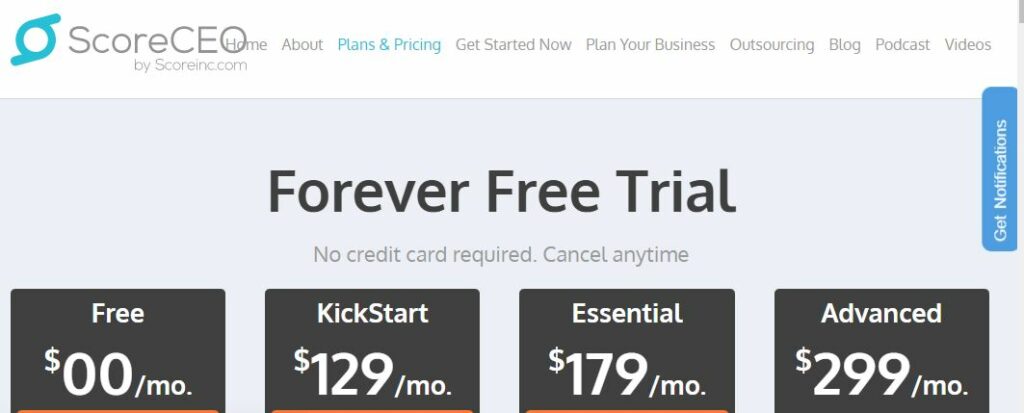

ScoreCeo

ScoreCeo is a complete software package for credit repair businesses. It’s designed to help businesses grow and increase their profits.

Users can go with the free trial or choose from one of the following three packages:

- Kickstart: $129 a month

- Essential: $179 a month

- Advanced: $299 a month

Each plan offers things like:

- Data analytics across organic search and social media

- Built-in compliance engine

- Sales workflow pipeline

- Revenue monitoring

- Credit report importing

- Robust engine of dispute letters

- Customer and affiliate portal

- Varying number of clients, users, and data

- Unlimited leads

- Chat, voice, and email support

- Invoicing and coaching services

Best Credit Repair Company for DIY Credit Repair

If you’re looking for a user-friendly credit repair company for DIY credit repair, here’s the best option.

Credit Versio

Credit Versio relies on artificial intelligence to analyze your credit reports and generate dispute letters to remove errors with all three bureaus. It is intuitive, easy to use, and has all the resources you need to build up your credit. Although it’s a newer company, it’s highly rated with 4.4 out of 5 stars on Trustpilot out of 287 reviews.

With Credit Versio, you can expect the following:

- Dispute letters for late payments, collections accounts, inquiries, charge-offs, judgments, repossessions, foreclosures, and bankruptcy

- Unlimited disputes at once

- Dispute monitoring

- Letters based on consumer protection laws

- Video credit coaching from credit experts

- Multiple proven strategies to remove errors

- Automatic importing of credit reports from all three bureaus without a hard inquiry

There are three main plans to choose from:

- Smartcredit Basic: This comes with unlimited disputes, credit monitoring and alerts, two monthly TransUnion reports, and regular score updates. It costs $19.95 a month, but you can add identity theft insurance for an additional $1.

- Smartcredit Premium: This plan includes the previous plan’s offerings plus unlimited TransUnion reports and score updates. It costs $24.95 a month.

- IdentityIQ: This includes all of the above plus identity theft insurance up to $25,000. It costs $29.95 a month.

Do I Need to Hire Credit Repair Professionals?

When you sign up for a credit repair service, a credit repair professional will scan your credit report, look for errors, and generate dispute letters. They’ll also send these letters to the credit bureaus reporting the errors to try to get the negative marks removed.

Once the bureau receives the letter, they have 30 days to investigate and, if it is actually a mistake, remove the mark. The entire process can give your credit a boost.

Most credit repair companies cost between $70 and $150 a month. Depending on the agency and plan, you could have up to an unlimited number of errors disputed.

In 2021, over a third of all adult American consumers found at least one error on their credit report. These errors are either related to account or personal information.

Personal information doesn’t directly impact your credit, but account information does. This includes things like:

- Late or missed payments that should have fallen off but didn’t

- Nonexistent accounts like loans or credit cards

- Wrongly reported closed accounts

- Other actions you didn’t take (ex. filing for bankruptcy)

Credit repair is something you can also do yourself, but a professional service can save you a lot of time and headache.

Software vs. a Credit Repair Company

Credit repair software will not fix your credit for you. Instead, it gives you the tools and resources you need to do it yourself. Some credit repair software is made for individual use, while other software is made for entrepreneurs or business owners.

Most software will help you check your credit, import the credit report, scan it for mistakes, and draft dispute letters to submit to the three major credit bureaus. Advanced programs can automate the entire dispute process from beginning to end, though you’ll still need to send the letters yourself.

These programs also often feature different credit management resources such as step-by-step guides and consumer law and credit education. Some offer access to legal or credit professionals to help with long-term credit repair.

A credit repair company does much the same, but they’ll do most of the heavy lifting on your behalf. In both cases, they’ll identify and dispute errors related to everything from late payments to charge-offs to accounts in collections. Companies are also more personalized than software, though they both use the same information to help rebuild your credit.

Credit repair software is best for those who have time and want to learn to improve their credit themselves. A company is better for those who don’t have time but can afford the potentially higher cost of the full service.

What’s the Credit Repair Process?

Whether you use software or go through a professional service, the credit repair process is fairly straightforward.

The first step is to obtain and look over your credit report from each bureau. This will give you an idea of what might be hurting your score. For example, if the report includes late payments on an account you were never late on, this could be worth disputing.

After identifying any possible errors, the next step is to take action to get them removed. Depending on the number of errors, this could take a few months or more to do.

To dispute an error, you’ll need to send a dispute letter to the reporting credit bureau and the company (or furnisher) that provided the incorrect information. Furnishers include creditors, lenders, landlords, and financial institutions.

For each error, you must send a separate dispute letter. The letter should be clear, concise, and include the following:

- Your contact information

- The account number

- Which item is incorrect and why it should be removed

- Clear request to correct or get rid of the error

- Copy of your credit report with the error listed

The credit bureau will then investigate the error and provide any relevant documents to the furnisher. If the bureau determines there’s merit to your claims, they’ll update the report. Otherwise, they’ll send a notice letting you know the item cannot be removed. If the furnisher corrects the information, they’ll notify any relevant credit bureaus so they can update the report.

Once the dispute process ends, request a new copy of your credit report to see the updated changes.

Why Does My Credit Score Matter?

Your credit score is an indicator of your creditworthiness.

Every time you apply for a new loan or credit card, the prospective lender or issuer will run a credit check to determine interest rates, loan terms, and eligibility. Your credit score can also determine how high of a deposit you pay for a rental or when setting up utilities. Some employers also check credit to see how responsible a candidate is.

About 90% of all lenders in the United States use the FICO score, which is broken down into the following:

- Exceptional: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Generally, you’ll need at least a 670 FICO score to qualify for most loan products at the best rates. The other main scoring model, VantageScore, also ranges from 300 to 850 with 700+ considered good or excellent.

Your credit score is based on things like payment history, credit utilization, age of credit, and credit mix. Negative items, such as late payments or foreclosures, can lower your credit score. Filing for bankruptcy can drag down your score for up to 10 years, making it harder to qualify for most forms of financing.

What Can Lead to a Bad Credit Score?

Many factors can lead to a bad credit score, including:

- Late or missed payments

- Accounts in collections

- High credit utilization ratio

- Closing old accounts in good standing (lowers overall age of credit)

- Multiple hard inquiries

- Bankruptcy

- Foreclosure

- Tax liens

- Identity theft

- Reporting errors

If you have poor credit due to errors in your report, the best thing you can do is dispute them. A successful dispute will remove or update the negative items and help your score bounce back.

One thing to keep in mind is that having no credit is not the same thing as having bad credit. No credit score simply means you’ve never established an account – credit card or loan – or that the account hasn’t been reported yet. Most lenders are more willing to work with borrowers with no credit than with poor credit.

How Can I Fix Errors on My Credit Report?

The Consumer Financial Protection Bureau suggests disputing any errors with the reporting bureau. You can either create your own letter or use a template. All three credit bureaus have dispute forms on their websites that you can fill out and send via mail.

Again, the dispute letter needs to have your current contact information, a clear description of the error, the associated account number, an explanation for the dispute, and your desired result. It’s also a good idea to include supporting documents such as a copy of the report showing the error.

Try to send the letter by certified mail. That way, you’ll have proof when the letter is officially delivered.

Another way is to file a dispute online through the reporting bureau’s official website. You can find each agency’s contact information here.

How Can I Increase My Own Credit Score?

Here are the best strategies to improve your credit score yourself.

Check Your Free Credit Reports

Get a free copy of your credit report from each of the major credit reporting agencies — Experian, TransUnion, and Equifax. Or request a copy of all three reports from annualcreditreport.com.

Review each report carefully and, if there are any errors, dispute them. Even if there aren’t errors, checking your report can give you a good idea of any areas needing improvement.

Learn Your FICO and VantageScore Numbers

FICO and VantageScore 3.0 both range from 300 to 850. Since most lenders, creditors, and other institutions use one of these scoring models, it’s important to know the difference between them.

For FICO, the most important factors are:

- Payment history: 35%

- Credit utilization (amount owed): 30%

- Overall age of credit: 15%

- Credit mix: 10%

- New credit inquiries: 10%

VantageScore doesn’t use a percentage-based system, but their scoring factors are:

- Payment history: Extremely influential

- Credit mix: Highly influential

- Total credit utilization: Moderately influential

- Age of credit: Less influential

- New accounts: Less influential

For FICO, score ranges are:

- Excellent: 800 to 850

- Very good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 300 to 579

For VantageScore, the ranges are:

- Excellent: 781 to 850

- Good: 661 to 780

- Fair: 601 to 660

- Poor: 500 to 600

- Very Poor: 300 to 499

Both of these scores are important when applying for financing or new lines of credit.

There are plenty of sources that offer a free credit score.

Automate Your Payments

Most lenders consider a payment late when it’s 15 to 30 days past due. Once it’s reported as late, the mark can remain on your credit report for up to seven years.

By setting up autopay, you can prevent late or missed payments. This can keep your credit on the right track and give you peace of mind knowing your bills are paid on time.

Just make sure you have the funds in the connected account. Otherwise, you could be subject to overdraft fees.

Focus on Paying Down Your Balances

Your credit utilization ratio is the difference between all of your available revolving credit and your current balance. Credit utilization makes up 30% of your credit score, so it’s a good idea to keep this percentage low.

Anytime you carry a balance on a credit card, you’re increasing your overall credit utilization ratio. Say, for example, your available credit is $1,000 and your total balance is $500. In this case, your credit utilization is 50%.

There are two ways to improve your credit utilization ratio. One is to increase your available limit by applying for a new credit card or credit increase. The other way is to start paying off your credit cards. Both options can help build your credit.

Get a Secured Credit Card and Use It

If you have poor credit, consider getting a secured credit card. With one, you deposit a small lump sum into an account that becomes your credit limit and serves as collateral.

You can use a secured credit card as if it were any other credit card. This means making purchases, paying at least the monthly minimums, and dealing with any fees (ex. late fees or annual fees). Since the initial deposit works as collateral, you could lose it if you fail to make payments.

The advantage of a secured card is that the card issuer will report any activity to the credit bureaus. This means you can build up credit through things like low credit utilization and on-time payments.

Limit Opening New Accounts or Lines of Credit

Whenever you apply for a new loan or credit card, the lender or issuer will run your credit report. This is known as a hard inquiry.

Each hard inquiry shows up on your report and can cause up to a 5-point drop in your credit score. This drop is usually temporary, meaning your score will bounce back after a few months with good credit habits.

However, if you have several hard inquiries in a short period, it can cause a more noticeable drop. Because of this, it’s best to limit the number of applications — and hard inquiries — on your account.

In certain cases, multiple hard inquiries might count as one when performed within a short period — usually 14 to 45 days. This mainly occurs when looking for the best mortgage or auto loan lender.

Protect Yourself from Identity Theft

Identity theft can happen to anyone and, in some cases, could hurt your credit score. Fortunately, there are a few ways to prevent this from happening.

For one, use a password manager tool to store, create, and organize your passwords for different applications and accounts. Also, avoid using public Wi-Fi networks when accessing private accounts or making financial transactions. These networks are far more vulnerable to hackers than private ones.

Apply for a Loan with a Co-Signer

If you don’t qualify for a loan or if the rates are bad, consider applying with a co-signer. A co-signer can improve your chances of approval since lenders and creditors will also take their credit score into account. They will, however, need to have good credit to qualify.

Make sure the co-signer understands the risks. If you fail to make payments, they will become responsible for the loan. Additionally, if you default on the loan, it could impact both of your credit scores.

When done correctly, a cosigned loan can give both individuals’ a credit score boost.

The Bottom Line

Credit repair software and professional agencies can both help improve your credit over time. Whichever option you choose, check your credit report once every few months or so to make sure everything’s on track. It also doesn’t hurt to start practicing better credit habits such as keeping credit utilization low and making on-time payments.

FAQs

A credit monitoring service will track your credit report and alert you to any changes. Some services are free, but they can cost up to $30 a month. They’re best for those who don’t have time to check their report or who’ve had problems with identity theft.

A charge-off happens when you’ve failed to repay a borrowed amount for a long time. At this point, the creditor might send the account to a debt collection agency. You’ll still owe the debt, but you’ll need to pay the agency instead. Charge-offs will drag your credit down and can remain on your report for up to seven years. If the charge-off is an error, you can try disputing it to have it removed.

A credit dispute letter is what lets you request an error on your credit report to be removed or updated. There are hundreds of dispute letter templates available online, each for different types of errors and situations. You can use one of these templates or write your own. In both cases, you’ll need to send the dispute letter via mail to the reporting bureau and relevant lender or financial institution.